IBM 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ............................................................. 64

A. Significant Accounting Policies ..................64

B. Accounting Changes ............................. 73

C. Acquisitions/Divestitures ...................... 76

D. Financial Instruments

(excluding derivatives).................................82

E. Inventories ...................................................83

F. Financing Receivables .................................83

G-M ..................................................................84

N-S ...................................................................94

T-W ................................................................102

As of December 31, 2005, the company was unable to estimate the

range of settlement dates and the related probabilities for certain

asbestos remediation AROs. These conditional AROs are primarily

related to the encapsulated structural fireproofing that is not subject to

abatement unless the buildings are demolished and non-encapsulated

asbestos that the company would remediate only if it performed major

renovations of certain existing buildings. Because these conditional

obligations have indeterminate settlement dates, the company could

not develop a reasonable estimate of their fair values. The company

will continue to assess its ability to estimate fair values at each future

reporting date. The related liability will be recognized once sufficient

additional information becomes available.

In June 2005, the FASB issued FSP No. FAS 143-1, “Accounting

for Electronic Equipment Waste Obligations,” (FSP FAS 143-1) that

provides guidance on how commercial users and producers of elec-

tronic equipment should recognize and measure asset retirement

obligations associated with the European Directive 2002/96/EC on

Waste Electrical and Electronic Equipment (the “Directive”). In

2005, the company adopted FSP FAS 143-1 in those European Union

(EU) member countries that transposed the Directive into country-

specific laws. Its adoption did not have a material effect on the

Consolidated Financial Statements. The effect of applying FSP FAS

143-1 in the remaining countries in future periods is not expected to

have a material effect on the Consolidated Financial Statements.

In the third quarter of 2005, the company adopted SFAS No. 153,

“Exchanges of Nonmonetary Assets, an amendment of APB Opinion

No. 29.” SFAS No. 153 requires that exchanges of productive assets be

accounted for at fair value unless fair value cannot be reasonably deter-

mined or the transaction lacks commercial substance. The adoption

of SFAS No. 153 did not have a material effect on the Consolidated

Financial Statements.

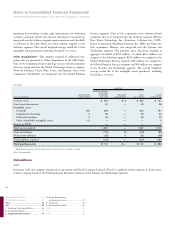

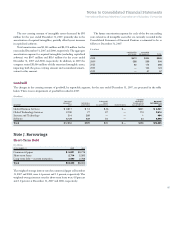

Note C. Acquisitions/Divestitures

Acquisitions

2007

In 2007, the company completed 12 acquisitions at an aggregate cost

of $1,144 million.

The Software segment completed six acquisitions: in the first

quarter, Consul Risk Management International BV and Vallent Cor-

por ation, both privately held companies. Four acquisitions were

completed in the third quarter: Watchfire Corporation, WebDialogs

Inc. and Princeton Softech Inc., all privately held companies, and

DataMirror Corporation, a publicly held company. Each acquisition

further complemented and enhanced the software product portfolio.

Global Technology Services completed four acquisitions: in the

first quarter, Softek Storage Solutions Corporation (Softek) and DM

Information Systems, Ltd. (DMIS), both privately held companies.

Two acquisitions were completed in the fourth quarter: Novus

Consulting Group, Inc. and Serbian Business Systems, both privately

held companies. Softek augments the company’s unified data mobility

offerings and worldwide delivery expertise for managing data in stor-

age array, host and virtualized IT environments. DMIS will enhance

and complement the Technology Service offerings. Novus CG, a

storage solution company, will provide improved access to business

information, enable stronger regulatory and corporate compliance

and improve overall information technology performance. Serbian

Business Systems establishes the company’s maintenance and techni-

cal support services business in Serbia.

Global Business Services completed one acquisition in the fourth

quarter: IT Gruppen AS, which will add to the company’s presence

in the retail and media sectors.

Systems and Technology completed one acquisition in the fourth

quarter: XIV, Ltd., a privately held company focused on storage

systems technology.

Purchase price consideration was paid in cash. These acquisitions

are reported in the Consolidated Statement of Cash Flows net of

acquired cash and cash equivalents.

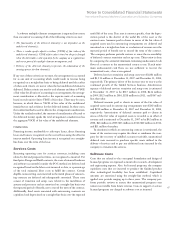

The table on page 77 reflects the purchase price related to these

acquisitions and the resulting purchase price allocations as of

December 31, 2007.

During the fourth quarter of 2007, the company entered into a

definitive agreement to acquire Cognos, Inc. The acquisition of

Cognos, Inc., a publicly held company, was completed in January

2008. The acquisition of Cognos, Inc. supports the Information on

Demand strategy and will provide the company with a strong entry

in the Business Intelligence market.

The closing of the Telelogic AB acquisition, announced in the

second quarter of 2007, is conditioned upon satisfactory completion

of regulatory reviews in the European Union. Regulatory reviews in

the U.S. have been completed.