IBM 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

36

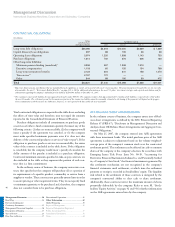

expense management. GBS revenue increased 16.8 percent (10 percent

adjusted for currency) with growth in all geographies and sectors.

Revenue performance was led by growth in AMS offerings and

double-digit growth across all consulting service lines. GBS signings

decreased 20 percent, driven by a 48-percent decline in longer term

signings when compared to a very strong fourth quarter of 2006.

Shorter term signings increased 9 percent to $3.9 billion for the

quarter, the highest level of shorter term signings achieved in any

quarter in this business. GBS gross profit increased 9.0 percent in the

quarter, with a gross margin decline of 1.7 points due to higher

employee bonus compensation costs. The GBS segment contributed

$0.6 billion of pre-tax profit in the quarter, an increase of 9.2 percent

versus the fourth quarter of 2006. Pre-tax profit margin declined 0.5

points to 11.3 percent driven primarily by the impact of higher

employee bonus compensation in the quarter, partially offset by

improved expense productivity.

Systems and Technology segment revenue was $6.8 billion, a

decrease of 3.9 percent as reported (8 percent adjusted for currency),

when compared to the fourth quarter of 2006; excluding the divested

printer business, revenue was essentially flat (decreased 4 percent

adjusted for currency). System z revenue decreased 15.1 percent,

with revenue declines in the U.S. and EMEA, partially offset by

double-digit revenue growth in Asia Pacific. This was the tenth quar-

ter of a long and successful technology cycle for System z; MIPS

shipments decreased 4 percent year to year. System i revenue

increased 2.0 percent driven primarily by growth in POWER6 servers.

System p revenue grew 9.5 percent, with growth in all geographies

led by double-digit growth in Asia Pacific. This was the sixth con-

secutive quarter of revenue growth for System p, driven primarily by

POWER6 servers. System x revenue increased 4.3 percent with

growth in server products (6 percent) and blades (31 percent).

Performance in the quarter reflected strong acceptance of the new

BladeCenter-S, which was introduced at the end of the quarter, and

strong demand for the new high-end Quad-Core processor servers.

Systems Storage revenue increased 10.8 percent, driven by growth in

tape products of 22 percent and external disk products of 7 percent.

Retail Store Solutions revenue increased 5.9 percent. Microelectronics

revenue declined 15.2 percent driven by a slowdown in demand for

game processors. Segment gross margin at 45.7 percent, improved

3.9 points versus the fourth quarter of 2006 with margin improve-

ment in every system brand, except System i. Systems and Technology

segment pre-tax profit increased 17.8 percent to $1.4 billion. Pre-tax

margin improved 3.8 points to 19.4 percent, driven primarily by

operational cost management, a mix to higher end models within the

brands and the value of the new POWER6 products in the market.

Software segment revenue of $6.3 billion, increased 11.6 percent

(6 percent adjusted for currency), reflecting strong execution in clos-

ing transactions in the quarter and continued strong demand for the

Key Branded Middleware products. Revenue growth this quarter was

primarily organic, as the company wrapped around prior year acqui-

sitions. Revenue from Key Branded Middleware increased 15.4 percent

(9 percent adjusted for currency) and represented 58 percent of total

software revenue. Revenue from the WebSphere Family of products

grew 22.8 percent in the quarter, with strong performance tied to the

industry’s adoption of services-oriented architecture. Information

Management revenue increased 11.4 percent. The FileNet acquisi-

tion, now in its second year, contributed to the revenue growth.

Lotus revenue increased 6.7 percent compared to a very strong

fourth quarter of 2006. This is the thirteenth consecutive quarter of

growth from Lotus software. Lotus Connections, which was released

in June 2007, has been rapidly adopted by customers. Tivoli software

revenue increased 19.0 percent with double-digit growth in Systems

Management, Security and Storage products. Rational revenue

increased 22.2 percent in the quarter, as the company’s largest cus-

tomers embraced this integrated product set. Software gross profit

increased 12.4 percent in the quarter, with margin improvement of

0.6 points. In addition to the strong revenue and gross profit perfor-

mance in the fourth quarter, the Software segment delivered pre-tax

profit of $2.4 billion, an increase of 20.8 percent. The pre-tax margin

of 34.9 percent increased 2.6 points, reflecting the strong revenue

growth with a relatively fixed cost base.

Global Financing revenue increased 7.7 percent (2 percent adjusted

for currency), driven primarily by increased sales of used equipment.

From a geographic perspective, revenue increased in all geogra-

phies, led by strong performance in Asia Pacific, EMEA and the

emerging countries. Americas’ revenue was $11.7 billion, an increase

of 4.8 percent as reported (2 percent adjusted for currency). EMEA

revenue increased 16.2 percent (6 percent adjusted for currency) to

$10.8 billion. Revenue increased in most of the major countries,

when adjusted for currency, led by Spain which was up 15 percent.

Asia Pacific revenue increased 14.7 percent (9 percent adjusted for

currency) to $5.5 billion, led by growth in the India, Greater China,

Australia/New Zealand, ASEAN and Korea regions. Collectively,

these regions increased 20.3 percent, adjusted for currency, versus

the fourth quarter of 2006. The emerging BRIC countries of Brazil,

Russia, India and China together grew 29.4 percent (18 percent

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ............................................ 23

Prior Year in Review .................................. 37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64