IBM 2007 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

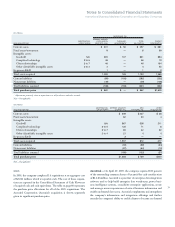

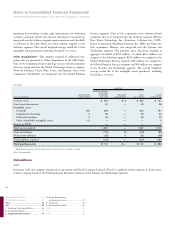

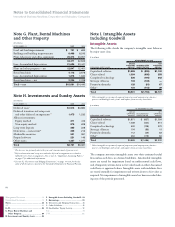

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

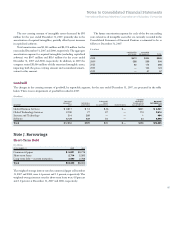

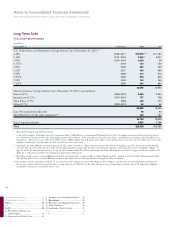

Goodwill

The changes in the carrying amount of goodwill, by reportable segment, for the year ended December 31, 2007, are presented in the table

below. There was no impairment of goodwill recorded in 2007:

($ in millions)

FOREIGN

BALANCE PURCHASE CURRENCY BALANCE

JANUARY 1, GOODWILL PRICE TRANSLATION DECEMBER 31,

SEGMENT 2007 ADDITIONS ADJUSTMENTS DIVESTITURES ADJUSTMENTS 2007

Global Business Services $ 3,811 $ 14 $ (5) $ — $221 $ 4,041

Global Technology Services 2,700 77 27 — 110 2,914

Systems and Technology 214 269 — — 1 484

Software 6,129 639 54 — 24 6,846

Total $12,854 $999 $76 $ — $356 $14,285

The net carrying amount of intangible assets decreased by $95

million for the year ended December 31, 2007, primarily due to the

amortization of acquired intangibles, partially offset by net increases

in capitalized software.

Total amortization was $1,163 million and $1,076 million for the

years ended December 31, 2007 and 2006, respectively. The aggregate

amortization expense for acquired intangibles (excluding capitalized

software) was $367 million and $316 million for the years ended

December 31, 2007 and 2006, respectively. In addition, in 2007 the

company retired $1,066 million of fully amortized intangible assets,

impacting both the gross carrying amount and accumulated amorti-

zation for this amount.

The future amortization expense for each of the five succeeding

years related to all intangible assets that are currently recorded in the

Consolidated Statement of Financial Position is estimated to be as

follows at December 31, 2007:

($ in millions)

CAPITALIZED ACQUIRED

SOFTWARE INTANGIBLES TOTAL

2008 $670 $324 $995

2009 338 266 604

2010 92 174 266

2011 — 124 124

2012 — 57 57

Note J. Borrowings

Short-Term Debt

($ in millions)

AT DECEMBER 31: 2007 2006

Commercial paper $ 5,831 $3,779

Short-term loans 2,714 2,355

Long-term debt — current maturities 3,690 2,768

Total $12,235 $8,902

The weighted-average interest rates for commercial paper at December

31, 2007 and 2006, were 4.4 percent and 5.3 percent, respectively. The

weighted-average interest rates for short-term loans were 4.8 percent

and 3.0 percent at December 31, 2007 and 2006, respectively.