IBM 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Management Discussion

International Business Machines Corporation and Subsidiary Companies

15

provisions of Statement of Financial Accounting Standards (SFAS) No. 6,

“Classification of Short-Term Obligations Expected to Be Refinanced,” the

company has classified this amount as Long-term debt in its Consolidated

Statement of Financial Position on page 59.

U Effective December 31, 2006, the company adopted the provisions of

SFAS No. 158, “Employer’s Accounting for Defined Benefit Pension and

Other Postretirement Plans, an amendment to FASB Statements No.

87, 88, 106, and 132(R).” SFAS No. 158 requires that the funded status

of the company’s pension and nonpension postretirement benefit plans be

recognized as an asset or a liability in the Consolidated Statement of

Financial Position, the recognition of any changes in that funded status

in the year in which the changes occur and the recognition of previously

unrecognized gains/(losses), prior service costs/(credits) and transition

assets as a component of Accumulated gains and (losses) not affecting

retained earnings in the Consolidated Statement of Stockholder’s Equity.

The adoption of SFAS No. 158 had a significant non-cash impact on the

company’s 2006 reported financial position and stockholder’s equity,

reducing equity by $9.5 billion, net of tax. The adoption of SFAS No.

158 had no impact on the company’s existing debt covenants, credit ratings

or financial flexibility. See note U, “Retirement-Related Benefits,” on

pages 105 to 116 for additional information, including 2007 impacts.

U The company divested its Personal Computing business to Lenovo on

April 30, 2005. The details of this significant transaction are discussed

in note C, “Acquisitions/Divestitures,” on pages 81 and 82. As a result

of this divestiture, the company’s reported financial results do not include

any activity in 2007 and 2006, but includes four months of activity for

the Personal Computing Division in 2005. This lack of comparable

periods has a material impact on the company’s reported revenue growth.

Therefore, in the Management Discussion, within the “Prior Year in

Review” section on pages 38 to 41, the company has presented an analysis

of revenue both on an as-reported basis and on a basis that excludes the

revenue from the divested Personal Computing business from the 2005

period. The company believes that the analysis that excludes the Personal

Computing revenue is a better indicator of operational revenue perfor-

mance on an ongoing basis.

U The reference to “adjusted for currency” in the Management Discussion

is made so that certain financial results can be viewed without the impacts

of fluctuating foreign currency exchange rates and therefore facilitates a

comparative view of business performance. See “Currency Rate Fluctuations”

on page 49 for additional information.

U Within the financial tables in this Annual Report, certain columns and

rows may not add due to the use of rounded numbers for disclosure pur-

poses. Percentages reported in the financial tables throughout this Annual

Report are calculated from the underlying whole-dollar numbers.

Organization of Information

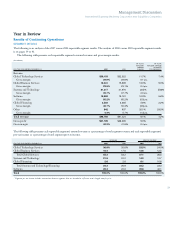

U This Management Discussion section provides the reader of the financial

statements with a narrative on the company’s financial results. It con-

tains the results of operations for each segment of the business, followed by

a description of the company’s financial position, as well as certain

employee data. It is useful to read the Management Discussion in con-

junction with note V, “Segment Information,” on pages 116 to 119.

U Global Financing is a reportable segment that is measured as if it were

a standalone entity. A separate “Global Financing” section is included

beginning on page 50. This section is separately presented given this

segment’s unique impact on the company’s financial condition and lever-

age, and the information presented in this section is consistent with this

separate company view.

U Pages 58 through 63 include the Consolidated Financial Statements.

These statements provide an overview of the company’s income and cash

flow performance and its financial position.

U The notes follow the Consolidated Financial Statements. Among other

items, the notes contain the company’s accounting policies (pages 64 to

73), acquisitions and divestitures (pages 76 to 82), detailed information

on specific items within the financial statements, certain contingencies

and commitments (pages 94 through 96), and the results of each report-

able segment (pages 116 to 119).

Discontinued Operations

On December 31, 2002, the company sold its hard disk drive (HDD)

business to Hitachi, Ltd. (Hitachi). The HDD business was accounted

for as a discontinued operation under generally accepted accounting

principles (GAAP) which requires that the income statement and

cash flow information be reformatted to separate the divested busi-

ness from the company’s continuing operations. See page 42 for

additional information.

Forward-Looking and

Cautionary Statements

Certain statements contained in this Annual Report may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements involve

a number of risks, uncertainties and other factors that could cause

actual results to be materially different, as discussed more fully else-

where in this Annual Report and in the company’s filings with the

Securities and Exchange Commission (SEC), including the company’s

2007 Form 10-K filed on February 26, 2008.