IBM 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

55

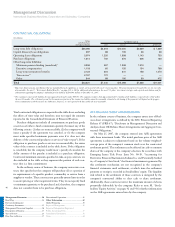

LIQUIDITY AND CAPITAL RESOURCES

Global Financing is a segment of the company and as such, is sup-

ported by the company’s overall liquidity position and access to capital

markets. Cash generated by Global Financing was primarily deployed

to reduce debt and pay dividends to the company in order to main-

tain an appropriate debt-to-equity ratio.

Return on Equity

($ in millions)

AT DECEMBER 31: 2007 2006

Numerator:

Global Financing After-tax income

(a)* $ 877 $ 914

Denominator:

Average Global Financing equity

(b)** $3,365 $3,097

Global Financing Return on equity

(a) /(b) 26.1% 29.5%

* Calculated based upon an estimated tax rate principally based on Global Financing’s

geographic mix of earnings as IBM’s provision for income taxes is determined on a

consolidated basis.

** Average of the ending equity for Global Financing for the last five quarters.

Critical Accounting Estimates

As discussed in the section, “Critical Accounting Estimates,” on page

47, the application of GAAP requires the company to make estimates

and assumptions about future events that directly affect its reported

financial condition and operating performance. The accounting esti-

mates and assumptions discussed in this section are those that the

company considers to be the most critical to Global Financing. The

company’s significant accounting policies are described in note A,

“Significant Accounting Policies,” on pages 64 to 73.

FINANCING RECEIVABLES RESERVES

Global Financing reviews its financing receivables portfolio at least

quarterly in order to assess collectibility. A description of the meth-

ods used by management to estimate the amount of uncollectible

receivables is included on page 73. Factors that could result in actual

receivable losses that are materially different from the estimated

reserve include sharp changes in the economy, or a significant change

in the economic health of a particular industry segment that repre-

sents a concentration in Global Financing’s receivables portfolio.

To the extent that actual collectibility differs from management’s

estimates by 5 percent, Global Financing after-tax income would be

higher or lower by an estimated $12 million (using 2007 data),

depending upon whether the actual collectibility was better or worse,

respectively, than the estimates.

RESIDUAL VALUE

Residual value represents the estimated fair value of equipment

under lease as of the end of the lease. Residual value estimates impact

the determination of whether a lease is classified as operating or

sales type. Global Financing estimates the future fair value of leased

equipment by using historical models, analyzing the current market

for new and used equipment and obtaining forward-looking product

information such as marketing plans and technological innovations.

Residual value estimates are periodically reviewed and “other than

temporary” declines in estimated future residual values are recog-

nized upon identification. Anticipated increases in future residual

values are not recognized until the equipment is remarketed. Factors

that could cause actual results to materially differ from the estimates

include significant changes in the used-equipment market brought

on by unforeseen changes in technology innovations and any result-

ing changes in the useful lives of used equipment.

To the extent that actual residual value recovery is lower than

management’s estimates by 5 percent, Global Financing’s after-tax

income would be lower by an estimated $21 million (using 2007

data). If the actual residual value recovery is higher than manage-

ment’s estimates, the increase in after-tax income will be realized at

the end of lease when the equipment is remarketed.

Market Risk

See pages 49 and 50 for discussion of the company’s overall mar-

ket risk.

Looking Forward

Given Global Financing’s primary mission of supporting IBM’s

hardware, software and services businesses, originations for both the

client and commercial financing businesses will be dependent upon

the overall demand for IT hardware, software and services, as well as

client participation rates.

Interest rates and the overall economy (including currency fluc-

tuations) will have an effect on both revenue and gross profit. The

company’s interest rate risk management policy, however, combined

with the Global Financing funding strategy (see page 54), should

mitigate gross margin erosion due to changes in interest rates. The

company’s policy of matching asset and liability positions in foreign

currencies will limit the impacts of currency fluctuations.

The economy could impact the credit quality of the Global

Financing receivables portfolio and therefore the level of provision

for bad debts. Global Financing will continue to apply rigorous

credit policies in both the origination of new business and the evalu-

ation of the existing portfolio.

As discussed on page 53, Global Financing has historically been

able to manage residual value risk both through insight into the

product cycles, as well as through its remarketing business.

Global Financing has policies in place to manage each of the key

risks involved in financing. These policies, combined with product

and client knowledge, should allow for the prudent management of

the business going forward, even during periods of uncertainty with

respect to the economy.