IBM 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

37

Prior Year in Review

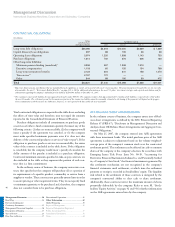

($ and shares in millions except per share amounts)

YR.-TO-YR.

PERCENT/

MARGIN

FOR THE YEAR ENDED DECEMBER 31: 2006 2005 CHANGE

Revenue $ 91,424 $ 91,134 0.3%*

Gross profit margin 41.9% 40.1% 1.8 pts.

Total expense and other income $ 24,978 $ 24,306 2.8%

Total expense and other

income-to-revenue ratio 27.3% 26.7% 0.7 pts.

Income from continuing

operations before income taxes $ 13,317 $ 12,226 8.9%

Provision for income taxes $ 3,901 $ 4,232 (7.8)%

Income from continuing

operations $ 9,416 $ 7,994 17.8%

Income/(loss) from

discontinued operations $ 76 $ (24) NM

Income before cumulative

effect of change in

accounting principle $ 9,492 $ 7,970 19.1%

Cumulative effect of change

in accounting principle,

net of tax** $ — $ (36) NM

Net income $ 9,492 $ 7,934 19.6%

Net income margin 10.4% 8.7% 1.7 pts.

Earnings per share of

common stock:

Assuming dilution:

Continuing operations $ 6.06 $ 4.91 23.4%

Discontinued operations 0.05 (0.01) NM

Cumulative effect of

change in accounting

principle** — (0.02) NM

Total $ 6.11 $ 4.87 25.5%

Weighted-average shares

outstanding:

Assuming dilution 1,553.5 1,627.6 (4.6)%

Assets

+ $103,234 $105,748 (2.4)%

Liabilities

+ $ 74,728 $ 72,650 2.9%

Equity

+ $ 28,506 $ 33,098 (13.9)%

* Flat adjusted for currency.

** Reflects implementation of FASB Interpretation No. 47, “Accounting for Conditional

Asset Retirement Obligations.” See note B, “Accounting Changes,” on page 75 for

additional information.

+ At December 31.

NM — Not meaningful

adjusted for currency). In addition to the BRIC markets, there are

many other nations with a similar profile that have demonstrated

rapidly growing markets with strong demand for business and IT

infrastructure solutions. In December 2007, the company announced

a new organization and management structure aimed at continuing

to capture these opportunities.

Total expense and other income increased 8.6 percent compared

to the fourth quarter of 2006. Total expense and other income to

revenue ratio improved 0.3 points to 25.9 percent. Selling, general

and administrative expense increased 7.0 percent (3 percent adjusted

for currency), primarily driven by currency, continuing investments

in key markets and acquisitions and increased accounts receivable

provisions. Interest expense was $214 million, an increase of $144

million versus the fourth quarter of 2006. The higher level of interest

expense was primarily driven by the increased debt utilized to fund the

ASR agreements in the second quarter. Other (income) and expense

was $98 million of income, a reduction of $52 million (34.5 percent)

versus the fourth quarter of 2006. A reduction in gains on real estate

transactions and losses from foreign currency transactions were par-

tially offset by increased interest income due to higher cash balances.

The company’s effective tax rate in the fourth-quarter 2007 was

28.0 percent, flat when compared to the fourth-quarter 2006 rate.

Share repurchases totaled approximately $0.5 billion in the fourth

quarter, including $0.3 billion related to the settlement of the ASR

agreements (see note M, “Stockholders Equity Activity,” on pages 92

and 93). The weighted-average number of diluted common shares

outstanding in the fourth quarter of 2007 was 1,412.9 million com-

pared with 1,532.5 million in the fourth quarter of 2006.

The company generated $5,151 million in cash flow provided by

operating activities, driven primarily by Net income. Net cash from

investing activities was a source of cash of $1,098 million in fourth

quarter of 2007 versus a use of cash of $5,634 million in the fourth

quarter of 2006, resulting primarily from the disposition of higher

levels of short term marketable securities.