IBM 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

46

Total contractual obligations are reported in the table above excluding

the effects of time value and therefore, may not equal the amounts

reported in the Consolidated Statement of Financial Position.

Purchase obligations include all commitments to purchase goods

or services of either a fixed or minimum quantity that meet any of the

following criteria: (1) they are noncancelable, (2) the company would

incur a penalty if the agreement was canceled, or (3) the company

must make specified minimum payments even if it does not take

delivery of the contracted products or services (“take-or-pay”). If the

obligation to purchase goods or services is noncancelable, the entire

value of the contract is included in the table above. If the obligation

is cancelable, but the company would incur a penalty if canceled, the

dollar amount of the penalty is included as a purchase obligation.

Contracted minimum amounts specified in take-or-pay contracts are

also included in the table as they represent the portion of each con-

tract that is a firm commitment.

In the ordinary course of business, the company enters into con-

tracts that specify that the company will purchase all or a portion of

its requirements of a specific product, commodity or service from a

supplier or vendor. These contracts are generally entered into in order

to secure pricing or other negotiated terms. They do not specify fixed

or minimum quantities to be purchased and, therefore, the company

does not consider them to be purchase obligations.

OFF-BALANCE SHEET ARRANGEMENTS

In the ordinary course of business, the company enters into off-bal-

ance sheet arrangements as defined by the SEC Financial Reporting

Release 67 (FRR-67), “Disclosure in Management’s Discussion and

Analysis about Off-Balance Sheet Arrangements and Aggregate Con-

tractual Obligations.”

On May 25, 2007, the company entered into ASR agreements

with three investment banks. The initial purchase price of the ASR

agreements is subject to adjustment based on the volume weighted-

average price of the company’s common stock over the contractual

settlement period. The settlement can be effected in cash or common

shares of the company at the company’s election. In accordance with

Emerging Issues Task Force Issue No. 00-19, “Accounting for

Derivative Financial Instruments Indexed to, and Potentially Settled

in, a Company’s Own Stock,” the financial instruments generated by

this settlement mechanism are not recognized in the company’s

financial statements until settlement, at which time the settlement

payment or receipt is recorded in Stockholders’ equity. The liquidity

risk related to the settlement of these contracts is mitigated by the

company’s contractual ability to elect cash or share settlement.

Additionally, these contracts restrict the maximum amount of shares

potentially deliverable by the company. Refer to note M, “Stock-

holders’ Equity Activity,” on pages 92 and 93 for further information

on the ASR agreements entered into by the company.

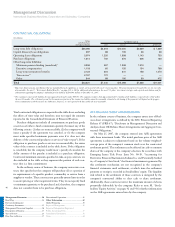

CONTRACTUAL OBLIGATIONS

($ in millions)

TOTAL

CONTRACTUAL PAYMENTS DUE IN

PAYMENT STREAM 2008 2009 -10 2011-12 AFTER 2012

Long-term debt obligations $26,066 $3,618 $10,450 $4,629 $ 7,369

Capital (finance) lease obligations 297 88 135 36 38

Operating lease obligations 5,074 1,220 1,958 1,143 753

Purchase obligations 1,814 702 676 306 130

Other long-term liabilities:

Minimum pension funding (mandated)* 3,258 637 1,308 1,313 —

Executive compensation 1,118 60 135 154 769

Long-term termination benefits 2,123 254 241 158 1,470

Tax reserves** 2,737 772 — — —

Other 844 89 195 89 472

Total $43,331 $7,440 $15,098 $7,828 $11,001

* Represents future pension contributions that are mandated by local regulations or statute, all associated with non-U.S. pension plans. The projected payments beyond 2012 are not currently

determinable. See note U, “Retirement-Related Benefits,” on pages 105 to 116 for additional information on the non-U.S. plans’ investment strategies and expected contributions and for

information regarding the company’s unfunded pension liability of $14,109 million at December 31, 2007.

** These amounts represent the liability for unrecognized tax benefits under FIN 48. The company estimates that approximately $772 million of the liability is expected to be settled within

the next 12 months. The settlement period for the noncurrent portion of the income tax liability cannot be reasonably estimated as the timing of the payments will depend on the progress

of tax examinations with the various tax authorities; however, it is not expected to be due within the next 12 months.

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information...................................... 42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64