IBM 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

107

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Plan Financial Information

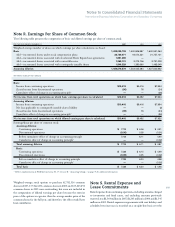

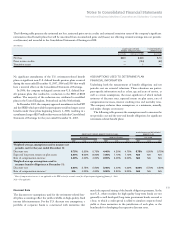

SUMMARY OF FINANCIAL INFORMATION

The following table presents a summary of the total retirement-related benefits net periodic cost recorded in the Consolidated Statement

of Earnings:

($ in millions)

U.S. PLANS NON-U.S. PLANS TOTAL

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005 2007 2006 2005 2007 2006 2005

Significant defined benefit pension plans* $ 368 $ 456 $ 381 $ 620 $ 639 $ 729 $ 988 $1,095 $1,110

Other defined benefit pension plans** 105 93 125 202 85 136 307 178 261

SERP 23 20 9 — — — 23 20 9

Total defined benefit pension plans cost $ 496 $ 569 $ 515 $ 822 $ 724 $ 865 $1,318 $1,293 $1,380

IBM Savings Plan and Non-U.S. Plans $ 390 $ 358 $ 331 $ 478 $ 377 $ 337 $ 868 $ 735 $ 668

EDCP 12 11 10 — — — 12 11 10

Total defined contribution plans cost $ 402 $ 370 $ 341 $ 478 $ 377 $ 337 $ 880 $ 747 $ 678

Nonpension postretirement

benefit plans cost $ 342 $ 335 $ 332 $ 57 $ 53 $ 47 $ 399 $ 388 $ 379

Total retirement-related

benefits net periodic cost $1,240 $1,274 $1,188 $1,357 $1,154 $1,249 $2,597 $2,428 $2,437

* Significant defined benefit pension plans consist of the qualified portion of the PPP in the U.S. and the material non-U.S. Plans. See page 108 for a list of significant plans.

** Other defined benefit pension plans consist of the non-qualified portion of the PPP in the U.S. and the non-material non-U.S. plans.

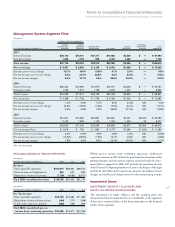

Nonpension Postretirement Benefit Plan

U.S. Nonpension Postretirement Plan

The company sponsors a defined benefit nonpension postretirement

benefit plan that provides medical and dental benefits to eligible U.S.

retirees and eligible dependents, as well as life insurance for eligible

U.S. retirees. Effective July 1, 1999, the company established a Future

Health Account (FHA) for employees who were more than five years

away from retirement eligibility. Employees who were within five

years of retirement eligibility are covered under the company’s prior

retiree health benefits arrangements. Under either the FHA or the

prior retiree health benefit arrangements, there is a maximum cost to

the company for retiree health benefits.

Effective January 1, 2004, new hires, as of that date or later, are

not eligible for company subsidized postretirement benefits.

NON-U.S. PLANS

Most subsidiaries and branches outside the United States sponsor

defined benefit and/or defined contribution plans that cover substan-

tially all regular employees. The company deposits funds under various

fiduciary-type arrangements, purchases annuities under group

contracts or provides reserves for these plans. Benefits under the

defined benefit plans are typically based either on years of service and

the employee’s compensation (generally during a fixed number of

years immediately before retirement) or on annual credits. The range

of assumptions that are used for the non-U.S. defined benefit plans

reflects the different economic environments within various countries.

In addition, certain of the company’s non-U.S. subsidiaries sponsor

defined benefit nonpension postretirement benefit plans that provide

medical and dental benefits to eligible non-U.S. retirees and eligible

dependents, as well as life insurance for certain eligible non-U.S.

retirees. However, most of the non-U.S. retirees are covered by local

government sponsored and administered programs.