IBM 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

29

Global Services revenue. In addition, Bad debt expense increased

$113 million primarily due to an increase in the provision for doubt-

ful accounts. The reserve coverage for receivables at year end was

1.5 percent, essentially flat versus year-end 2006. Workforce reduc-

tions — ongoing increased as a result of actions taken to address cost

issues in GTS, primarily in SO, during the second quarter of 2007.

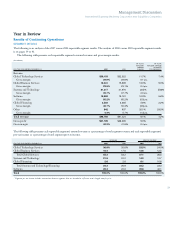

Other (Income) and Expense

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006* CHANGE

Foreign currency

transaction gains $(143) $(130) 10.1%

Losses on derivative instruments 382 135 183.5

Interest income (565) (536) 5.3

Net gains from securities

and investments assets (68) (40) 68.5

Net realized gains from

certain real estate activities (18) (41) (56.0)

Other (214) (154) 39.3

Total $(626) $(766) (18.3)%

* Reclassified to conform with 2007 presentation deleting 2006 categories for Restructuring

$(7) million and $(45) million for Lenovo/Microsoft gains and combining these items in

the Other category for both years.

Other (income) and expense was income of $626 million and $766

million in 2007 and 2006, respectively. The decrease in income was

primarily due to higher losses on derivative instruments. The com-

pany hedges its major cross-border cash flows to mitigate the effect

of currency volatility in the year-over-year results. The impact of

these hedging programs is primarily reflected in Other (income) and

expense, as well as cost of goods sold. This year, losses from deriva-

tives, as a result of currency movements, resulted in $247 million of

year-to-year impact to Other (income) and expense. This decrease in

income was partially offset by a gain from the divestiture of the printing

business in the second quarter and sales of Lenovo stock in the first

and second quarters of 2007 (see note C, “Acquisitions/Divestitures,”

on pages 80 and 81 for additional information).

Research, Development and Engineering

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Research, development

and engineering:

Total $6,153 $6,107 0.8%

Total Expense and Other Income

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Total expense and other income $27,240 $24,978 9.1%

Expense to Revenue 27.6% 27.3% 0.3 pts.

Total expense and other income increased 9.1 percent (5 percent

adjusted for currency) in 2007 versus 2006. Overall, the increase was

primarily due to increased Selling, general and administrative

(SG&A) expense and Interest expense. SG&A expense increased

$1,801 million primarily due to acquisition related spending, as well

as increased investments in emerging countries and the software and

services businesses. Interest expense increased $333 million primarily

due to higher debt associated with the financing of the ASR agree-

ments. In addition, Other (income) and expense declined $140 million

in income primarily due to higher losses on derivative instruments.

The expense-to-revenue ratio increased 0.3 points to 27.6 percent in

2007, as revenue increased 8.1 percent and expense increased 9.1

percent in 2007 versus 2006. For additional information regarding

the increase in Total expense and other income, see the following

analyses by category:

Selling, General and Administrative

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006* CHANGE

Selling, general and

administrative — base $19,078 $17,457 9.3%

Advertising and promotional expense 1,242 1,195 3.9

Workforce reductions — ongoing 318 272 16.6

Amortization expense —

acquired intangibles 234 220 6.7

Retirement-related expense 607 587 3.5

Stock-based compensation 480 541 (11.3)

Bad debt expense 100 (13) NM

Total $22,060 $20,259 8.9%

* Reclassified to conform with 2007 presentation as the Restructuring category ($33 million

in 2007 and $15 million in 2006) was combined into the SG&A — base category.

NM — Not meaningful

Total SG&A expense increased 8.9 percent (6 percent adjusted for

currency). The increase was primarily driven by acquisition-related

spending (3 points), the effects of currency (3 points) and investments

in the software and services businesses, as well as emerging markets.

These investments reflect the continuing business mix shift to higher

value offerings which require higher operating expenses. The returns

on these investments are reflected in the momentum in Key Branded

Middleware offerings, growth in emerging markets and improved