IBM 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

LOANS AND FINANCING RECEIVABLES

Estimates of fair value are based on discounted future cash flows

using current interest rates offered for similar loans to clients with

similar credit ratings for the same remaining maturities.

RESTRICTED SECURITIES

The fair value of restricted securities was estimated based on a quoted

price for an identical unrestricted security, adjusted to reflect the

effect of the restriction.

LONG-TERM DEBT

For publicly-traded debt, estimates of fair value are based on market

prices. For other debt, fair value is estimated based on rates cur-

rently available to the company for debt with similar terms and

remaining maturities.

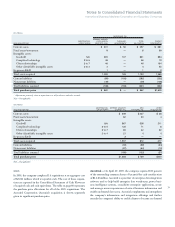

Marketable Securities*

The following table summarizes the company’s marketable securities,

all of which are considered available-for-sale, and alliance investments.

($ in millions)

FAIR VALUE

AT DECEMBER 31: 2007 2006

Marketable securities — current:

Time deposits and other obligations

$1,155 $2,634

Marketable securities — noncurrent:**

Time deposits and other obligations

$ 530 $ 359

Non-U.S. government securities and

other fixed-term obligations 1 2

Total $ 531 $ 361

Non-equity method alliance investments** $ 879 $ 628

* Gross unrealized gains (before taxes) on marketable securities were $7 million and $19

million at December 31, 2007 and 2006, respectively. Gross unrealized gains (before

taxes) on alliance investments were $545 million and $178 million at December 31, 2007

and 2006, respectively. Gross unrealized losses (before taxes) on marketable securities

were immaterial to the Consolidated Financial Statements at December 31, 2007 and

2006. Gross unrealized losses (before taxes) on alliance investments were $18 million

at December 31, 2007 and immaterial to the Consolidated Financial Statements at

December 31, 2006. See note M, “Stockholders’ Equity Activity,” on page 93 for net

change in unrealized gains and losses on marketable securities.

** Included within Investments and sundry assets in the Consolidated Statement of Financial

Position. See note H, “Investments and Sundry Assets,” on page 84.

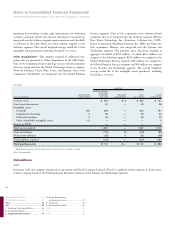

Note E. Inventories

($ in millions)

AT DECEMBER 31: 2007 2006

Finished goods $ 668 $ 506

Work in process and raw materials 1,996 2,304

Total $2,664 $2,810

Note F. Financing Receivables

($ in millions)

AT DECEMBER 31: 2007 2006

Current:

Net investment in sales-type leases $ 4,746 $ 4,590

Commercial financing receivables 6,263 5,814

Client loan receivables 4,652 4,196

Installment payment receivables 629 496

Total $16,289 $15,095

Noncurrent:

Net investment in sales-type leases $ 6,085 $ 5,471

Commercial financing receivables 113 32

Client loan receivables 4,931 4,214

Installment payment receivables 474 351

Total $11,603 $10,068

Net investment in sales-type leases is for leases that relate principally

to the company’s equipment and are for terms ranging from two to

seven years. Net investment in sales-type leases includes unguaran-

teed residual values of $915 million and $854 million at December

31, 2007 and 2006, respectively, and is reflected net of unearned

income of $1,016 million and $1,005 million and of allowance for

uncollectible accounts of $127 million and $135 million at those

dates, respectively. Scheduled maturities of minimum lease payments

outstanding at December 31, 2007, expressed as a percentage of the

total, are approximately: 2008, 50 percent; 2009, 30 percent; 2010,

15 percent; 2011, 5 percent; and 2012 and beyond, 1 percent.

Commercial financing receivables relate primarily to inventory

and accounts receivable financing for dealers and remarketers of IBM

and non-IBM products. Payment terms for inventory and accounts

receivable financing generally range from 30 to 90 days.

Client loan receivables relate to loans that are provided by Global

Financing primarily to the company’s clients to finance the purchase

of the company’s software and services. Separate contractual relation-

ships on these financing arrangements are for terms ranging from

two to seven years. Each financing contract is priced independently

at competitive market rates. The company has a history of enforcing

the terms of these separate financing agreements.

The company utilizes certain of its financing receivables as col-

lateral for non-recourse borrowings. Financing receivables pledged

as collateral for borrowings were $258 million and $304 million at

December 31, 2007 and 2006, respectively. These borrowings are

included in note J, “Borrowings,” on pages 85 to 88.

The company did not have any financing receivables held for sale

as of December 31, 2007 and 2006.