IBM 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.81

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

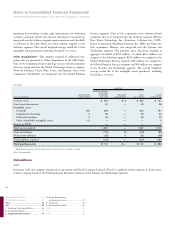

The company initially created a wholly owned subsidiary, InfoPrint

Solutions Company, LLC (InfoPrint), by contributing specific assets

and liabilities from its printer business. The Printing Systems

Division generated approximately $1 billion of revenue in 2006. The

InfoPrint portfolio includes solutions for production printing for

enterprises and commercial printers as well as solutions for office

workgroup environments and industrial segments. On June 1, 2007

(“closing date”), the company divested 51 percent of its interest in

InfoPrint to Ricoh. The company will divest its remaining 49 percent

ownership to Ricoh quarterly over the next three years from the clos-

ing date. At December 31, 2007, the company’s ownership in InfoPrint

was 40.8 percent.

The total consideration the company agreed to on January 24,

2007 (the date the definitive agreement was signed) was $725 million

which was paid in cash to the company on the closing date. The cash

received was consideration for the initial 51 percent acquisition of

InfoPrint by Ricoh as well as a prepayment for the remaining 49

percent to be acquired and certain royalties and services to be pro-

vided by the company to InfoPrint. Final consideration for this

transaction will be determined at the end of the three-year period

based upon the participation in the profits and losses recorded by the

equity partners. The company evaluated its ownership and participa-

tion in InfoPrint under the requirements of FIN 46(R). The company

concluded that InfoPrint met the requirements of a variable interest

entity, the company is not the primary beneficiary of the entity and

that deconsolidation of the applicable net assets was appropriate. The

company’s investment in InfoPrint will be accounted for under the

equity method of accounting.

The company will provide maintenance services for one year,

certain hardware products for three years and other information

technology and business process services to InfoPrint for up to five

years. The company assessed the fair value of these arrangements,

and, as a result, deferred $274 million of the proceeds. This amount

will be recorded as revenue, primarily in the company’s services seg-

ments, as services are provided to InfoPrint.

The royalty agreements are related to the use of certain of the

company’s trademarks for up to 10 years. The company assessed the

fair value of these royalty agreements, and, as a result, deferred

$116 million of the proceeds. This amount will be recognized as

Intellectual property and custom development income as it is

earned in subsequent periods.

Net assets contributed, transaction related expenses and provi-

sions were $90 million, resulting in an expected total pre-tax gain of

$245 million, of which $81 million was recorded in Other (income)

and expense in the Consolidated Statement of Earnings in the second

quarter of 2007.

The deferred pre-tax gain of $164 million at the closing date was

primarily related to: (1) the transfer of the company’s remaining 49

percent interest in InfoPrint to Ricoh, and, (2) the transfer of certain

maintenance services employees to InfoPrint. The company will

recognize this amount over a three year period as the remaining

ownership interest is divested and the employees are transferred. The

pre-tax gain will be recorded in Other (income) and expense in the

Consolidated Statement of Earnings.

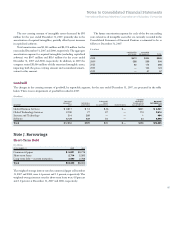

As discussed below and on page 82, the company divested its

Personal Computing Business to Lenovo in 2005. A portion of the

total consideration received in that transaction included Lenovo

equity. This equity was subject to specific lock-up provisions. These

restrictions were modified in 2006 as discussed below.

In 2007, the company divested 523 million shares of Lenovo com-

mon stock with proceeds approximating $204 million. At December

31, 2007 the company’s equity in Lenovo represented 4.8 percent of

ordinary voting shares and 8.8 percent of total ownership.

For the year ended December 31, 2007, the company recorded a

pre-tax gain of $30 million related to the divestiture. This amount

was primarily due to a reversal of an indemnity provision recorded at

the closing.

2006

As discussed above, a portion of the total consideration received in

the Personal Computing business divestiture included Lenovo equity.

This equity was subject to specific lock-up provisions at closing.

In the second quarter of 2006, the company and Lenovo agreed

to revise these restrictions such that the company can now fully divest

its shares in Lenovo after November 1, 2007 versus the prior lock-up

expiration date of May 1, 2008. As a result of the change in the lock-up

restrictions, the company considers all Lenovo shares to be within the

scope of SFAS No. 115 and has classified them as available-for-sale.

On August 4, 2006, the company signed an agreement with a

financial institution to establish a structure, with the institution act-

ing as agent, to facilitate the company’s disposition of Lenovo shares

from time to time, after their release from the lock-up provisions. At

December 31, 2006, the company had not divested any shares

through the financial institution.

For the year ended December 31, 2006, the company recorded a

pre-tax gain of $45 million related to the divestiture. This amount

was primarily due to a reversal of an indemnity provision recorded

at the closing.

2005

On April 30, 2005 (closing date), the company completed the divesti-

ture of its Personal Computing business to Lenovo, a publicly traded

company on the Hong Kong Stock Exchange. The total consideration

that the company agreed to on December 7, 2004 (the date the

definitive agreement was signed) was $1,750 million which included

$650 million in cash, $600 million in Lenovo equity (valued at the

December 6, 2004 closing price) and the transfer of approximately

$500 million of net liabilities. At the closing date, total consideration