IBM 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

32

In addition, Stockholders’ equity improved $4.7 billion as a result

of changes from pension remeasurements and current year activity

within Accumulated gains and (losses) not affecting retained earn-

ings. See note U, “Retirement-Related Benefits,” on pages 105 to

116 for additional information.

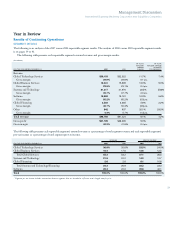

Working Capital

($ in millions)

AT DECEMBER 31: 2007 2006

Current assets $53,177 $44,660

Current liabilities 44,310 40,091

Working capital $ 8,867 $ 4,569

Current ratio 1.20 1.11

Working capital increased $4,298 million compared to the prior year

primarily as a result of a net increase in Current assets. The key driv-

ers are described below:

Current assets increased $8,517 million due to:

U An increase of $5,490 million in Cash and cash equivalents and Marketable

securities including a $299 million currency impact. See Cash Flow

analysis on page 33.

U An increase of $1,941 million in short-term receivables driven by:

— increase of $460 million in financing receivables due to asset growth

in commercial financing and client loans; and

— approximately $1,325 million currency impact.

U An increase of $1,351 million in Prepaid expenses and other current assets

primarily resulting from:

— an increase of $335 million in derivative assets primarily due to

changes in foreign currency rates for certain cash flow hedges;

— an increase of $164 million due to prepaid software for services contracts

($94 million) and maintenance agreements ($70 million);

— an increase of $170 million in prepaid taxes;

— an increase of $128 million in deferred services arrangements transi-

tion costs; and

— approximately $158 million currency impact.

Current liabilities increased $4,220 million as a result of:

U An increase of $3,333 million in Short-term debt primarily driven by

increases in commercial paper;

U An increase of $1,215 million in Deferred income mainly driven by

Software ($502 million) and Global Technology Services ($543 million);

subject to an adjustment based on the volume weighted average price

of the shares during this period and this adjustment will be recorded

in Stockholders’ equity in the Consolidated Statement of Financial

Position on each of the settlement dates. The first settlement

occurred on September 6, 2007, resulting in a settlement payment by

the company of $151.8 million; the second settlement occurred on

December 5, 2007, resulting in a settlement payment by the com-

pany of $253.1 million. The final settlement is expected to occur in

March 2008.

The ASR transaction was guaranteed by the company and was

executed through IBM International Group (IIG), a wholly owned

foreign subsidiary of the company. The formation of IIG enabled the

company to create a centralized foreign holding subsidiary to own

most of its non-U.S. operations. IIG funded the repurchases with $1

billion in cash and an $11.5 billion, 364-day bridge loan with a num-

ber of financial institutions. The bridge loan was guaranteed by the

company and carries an interest rate of the LIBOR plus 10 basis

points. Principal and interest on IIG debt will be paid by IIG with

cash generated by its non-U.S. operating subsidiaries. The execution

of the ASR enabled the company to achieve a substantial share reduc-

tion, a lower cost of capital and an effective use of non-U.S. cash.

In the second half of 2007, IBM International Group Capital

LLC (IIGC), an indirect, wholly owned subsidiary of the company,

issued $4.1 billion in long-term debt and $2.8 billion in commercial

paper. These proceeds were utilized to refinance the bridge loan

associated with the ASR. In addition, approximately $750 million of

the original amount has been repaid. At December 31, 2007, the

outstanding balance of the bridge loan was $3.9 billion.

In addition, on January 29, 2008, IIGC issued $3.5 billion of

18-month floating rate notes. The proceeds will be utilized to further

reduce the bridge loan associated with the ASR.

Consistent with retirement and postretirement plan accounting

standards, the company remeasures the funded status of its plans at

December 31. The funded status is measured as the difference between

the fair value of the plan assets and the benefit obligation. The funded

status is recognized in the Consolidated Statement of Financial Posi-

tion. (See note A, “Significant Accounting Policies,” on pages 69 and

70 for additional information). At December 31, 2007, as a result of

the company’s plan contributions, returns on plan assets and changes

in certain retirement plan assumptions, the overall net funded status

improved $7.2 billion from December 31, 2006 to a net over-funded

position of $3.3 billion. This change is primarily reflected in Prepaid

pension assets in the Consolidated Statement of financial position

which increased $6.8 billion from the prior year-end balance.

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ............................................ 23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64