IBM 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

16

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ............ 16

Description of Business ............................. 17

Year in Review ..................................................23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64

Continuing Operations

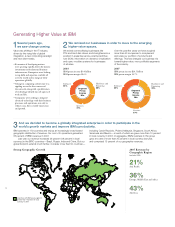

The company’s performance in 2007 reflected the strength of its

global model. Revenue increased in all geographies, with strong

growth in emerging markets worldwide. The company capitalized on

the opportunities in the global economies, generating 63 percent of

its revenue outside the United States, in delivering full-year growth

of 8.1 percent (4 percent adjusted for currency).

Gross profit margins improved reflecting a shift to higher value

offerings and continued benefits from productivity initiatives and the

transformation to a globally integrated enterprise. Pre-tax income

from continuing operations grew 8.8 percent and Net income from

continuing operations increased 10.6 percent versus 2006. Diluted

earnings per share improved 18.5 percent, reflecting the strong

growth in Net income and the benefits of the common stock repur-

chase program. In 2007, the company repurchased approximately

$18.8 billion of its common stock, including a $12.5 billion ASR in

the second quarter.

The increase in 2007 revenue, as compared to 2006, was primarily

due to:

U Strong performance from Global Technology Services and Global Business

Services with growth in all business lines;

U Continued strong demand in the Software business, driven by Key Branded

Middleware products, with positive contributions from strategic acquisi-

tions; and

U Continued growth in emerging countries (Brazil, Russia, India and

China: up 26 percent) and solid performance in all geographies, led by

Asia Pacific.

The increase in Income from continuing operations before income

taxes in 2007 was primarily due to:

U Revenue growth as discussed above; and

U Gross profit margin improvements in the Global Services and Systems

and Technology segments.

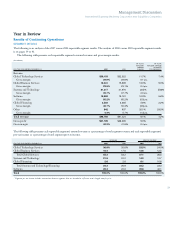

Management Discussion Snapshot

($ and shares in millions except per share amounts)

YR .-T O -YR.

PERCENT/

MARGIN

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Revenue $ 98,786 $ 91,424 8.1%*

Gross profit margin 42.2% 41.9% 0.4 pts.

Total expense and other income $ 27,240 $ 24,978 9.1%

Total expense and other

income-to-revenue ratio 27.6% 27.3% 0.3 pts.

Income from continuing

operations before income taxes $ 14,489 $ 13,317 8.8%

Provision for income taxes $ 4,071 $ 3,901 4.4%

Income from continuing

operations $ 10,418 $ 9,416 10.6%

Net income $ 10,418 $ 9,492 9.7%

Net income margin 10.5% 10.4% 0.2 pts.

Earnings per share of

common stock:

Assuming dilution:

Continuing operations $ 7.18 $ 6.06 18.5%

Discontinued operations (0.00) 0.05 NM

Total $ 7.18 $ 6.11 17.5%

Weighted-average shares

outstanding:

Diluted 1,450.6 1,553.5 (6.6)%

Assets** $120,431 $103,234 16.7%

Liabilities** $ 91,962 $ 74,728 23.1%

Equity** $ 28,470 $ 28,506 (0.1)%

* 4.2 percent adjusted for currency.

** At December 31.

NM — Not meaningful