IBM 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ...................................................................64

G-M ............................................................ 84

G. Plant, Rental Machines and

Other Property ...........................................84

H. Investments and Sundry Assets ..................84

I. Intangible Assets Including Goodwill ........84

J. Borrowings ..................................................85

K. Derivatives and Hedging Transactions.. 88

L. Other Liabilities .................................... 91

M. Stockholders’ Equity Activity .....................92

N-S ...................................................................94

T-W ................................................................102

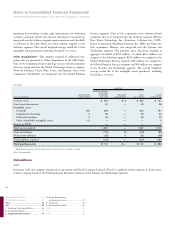

The following tables summarize the net fair value of the derivative instruments and the carrying value of foreign currency denominated

debt designated as a hedge of net investment at December 31, 2007 and 2006 (included in the Consolidated Statement of Financial Position).

($ in millions)

HEDGE DESIGNATION

NET NON-HEDGE/

AT DECEMBER 31, 2007 FAIR VALUE CASH FLOW INVESTMENT OTHER

Derivatives — net asset/(liability):

Debt risk management $167 $ 291 $ — $ 50

Long-term investments in foreign subsidiaries (“net investments”) — — (937) —

Anticipated royalties and cost transactions — (203) — —

Anticipated commodity purchase transactions — — — —

Subsidiary cash and foreign currency asset/liability management — — — (56)

Equity risk management — — — 30

Other derivatives — — — 6

Total derivatives 167(a) 88(b) (937)(c) 30(d)

Debt:

Long-term investments in foreign subsidiaries (“net investments”) — — (2,787)(e) —

Total $167 $ 88 $(3,724) $ 30

(a) Comprises assets of $181 million and liabilities of $14 million.

(b) Comprises assets of $526 million and liabilities of $438 million.

(c) Comprises liabilities of $937 million.

(d) Comprises assets of $90 million and liabilities of $60 million.

(e) Represents foreign currency denominated debt formally designated as a hedge of net investment.

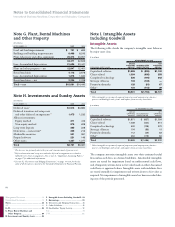

($ in millions)

HEDGE DESIGNATION

NET NON-HEDGE/

AT DECEMBER 31, 2006 FAIR VALUE CASH FLOW INVESTMENT OTHER

Derivatives — net asset/(liability):

Debt risk management $(139) $110 $ — $(96)

Long-term investments in foreign subsidiaries (“net investments”) — — (165) —

Anticipated royalties and cost transactions — (84) — —

Anticipated commodity purchase transactions — (2) — —

Subsidiary cash and foreign currency asset/liability management — — — (14)

Equity risk management — — — 40

Other derivatives — — — 10

Total derivatives (139)(a) 24(b) (165)(c) (60)(d)

Debt:

Long-term investments in foreign subsidiaries (“net investments”) — — (2,529)(e) —

Total $(139) $ 24 $(2,694) $(60)

(a) Comprises assets of $1 million and liabilities of $140 million.

(b) Comprises assets of $293 million and liabilities of $269 million.

(c) Comprises assets of $42 million and liabilities of $207 million.

(d) Comprises assets of $74 million and liabilities of $134 million.

(e) Represents foreign currency denominated debt formally designated as a hedge of net investment.