IBM 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

53

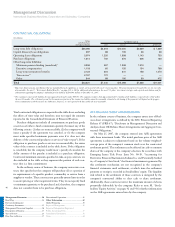

ROLL-FORWARD OF FINANCING RECEIVABLES

ALLOWANCE FOR DOUBTFUL ACCOUNTS

($ in millions)

ADDITIONS/

ALLOWANCE (REDUCTIONS) DEC. 31,

JAN. 1, 2007 USED* A/R PROVISION OTHER** 2007

$370 $(101) $70 $29 $368

* Represents reserved receivables, net of recoveries, that were disposed of during the period.

** Primarily represents translation adjustments.

The percentage of financing receivables reserved decreased from 1.5

percent at December 31, 2006, to 1.3 percent at December 31, 2007

primarily due to the decrease in the specific allowance for doubtful

accounts. Specific reserves decreased 21.8 percent from $294 million

at December 31, 2006 to $230 million at December 31, 2007 due to

the disposition of reserved receivables during the period combined

with lower requirements for additional specific reserves. This lower

requirement is generally due to the credit quality of the portfolio, as

well as portfolio management to reduce credit risk. Unallocated

reserves increased 81.6 percent from $76 million at December 31,

2006, to $138 million at December 31, 2007 primarily due to the

significant growth of the financing receivables portfolio. Global

Financing’s provision expense was an addition of $70 million for the

year ended December 31, 2007 and a reduction of $20 million for the

year ended December 31, 2006. The increase was primarily attrib-

uted to the growth of the unallocated reserves.

RESIDUAL VALUE

Residual value is a risk unique to the financing business and manage-

ment of this risk is dependent upon the ability to accurately project

future equipment values at lease inception. Global Financing has

insight into the product plans and cycles for the IBM products under

lease. Based upon this information, Global Financing continually

monitors projections of future equipment values and compares them

with the residual values reflected in the portfolio. See note A,

“Significant Accounting Policies,” on page 73 for the company’s

accounting policy for residual values.

Global Financing optimizes the recovery of residual values by

selling assets sourced from end of lease, leasing used equipment to

new clients or extending lease arrangements with current clients.

Sales of equipment, which are primarily sourced from equipment

returned at end of lease, represented 37.3 percent of Global

Financing’s revenue in 2007 and 39.8 percent in 2006. The decrease

was due to the decline in internal used equipment sales, partially

offset by the increase in external used equipment sales. The gross

margin on these sales was 43.7 percent and 38.1 percent in 2007 and

2006, respectively. The increase was driven primarily by higher mar-

gin internal used equipment sales.

The table on page 54 presents the recorded amount of unguaran-

teed residual value for sales-type and operating leases at December

31, 2006 and 2007. In addition, the table presents the residual value

as a percentage of the original amount financed, and a schedule of

when the unguaranteed residual value assigned to equipment on

leases at December 31, 2007 is expected to be returned to the com-

pany. In addition to the unguaranteed residual value, on a limited

basis, Global Financing will obtain guarantees of the future value of

the equipment to be returned at end of lease. These third-party

guarantees are included in minimum lease payments as provided for

by accounting standards in the determination of lease classifications

for the covered equipment and provide protection against risk of loss

arising from declines in equipment values for these assets. The resid-

ual value guarantee increases the minimum lease payments that are

utilized in determining the classification of a lease as a sales-type lease

or an operating lease. The aggregate asset values associated with the

guarantees were $682 million and $794 million for financing transac-

tions originated during the years ended December 31, 2007 and 2006,

respectively. In 2007, the residual value guarantee program resulted

in the company recognizing approximately $483 million of revenue

that would otherwise have been recognized in future periods as oper-

ating lease revenue. If the company had chosen to not participate in

a residual value program in 2007 and prior years, overall revenues

would not have been materially affected due to the relatively constant

year-to-year aggregate asset value associated with the residual value

guarantees. The associated aggregate guaranteed future values at the

scheduled end of lease were $38 million each for financing transac-

tions originated during the same time periods, respectively. The cost

of guarantees was $5 million per year in 2007 and 2006.