IBM 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

27

Software segment revenue of $19,982 million increased 10.0 percent

(6 percent adjusted for currency) in 2007 reflecting strong demand

for the Key Branded Middleware products. Revenue performance was

led by double-digit growth in the Financial Services, Public and Small

and Medium Business sectors. Clients are using IBM middleware to

effectively improve their operating leverage and business efficiency.

Revenue from Key Branded Middleware, which includes

WebSphere, Information Management, Lotus, Tivoli and Rational

products, was $10.8 billion, up 15.5 percent (11 percent adjusted for

currency) and increased 3 points to 54 percent of total Software seg-

ment revenue. The company has invested heavily in these products,

through internal investments and targeted acquisitions, and expects

the majority of its software revenue growth to come from this por-

tion of the product portfolio.

Revenue from the WebSphere Family of products increased 19.1

percent (14 percent adjusted for currency) and was led by double-

digit growth in WebSphere Application Servers and WebSphere

Business Integration software. The strong revenue performance

reflects the industry’s adoption of SOA. The WebSphere products

provide the foundation for Web-enabled applications and are a key

product set in deploying a client’s SOA.

Information Management revenue increased 14.7 percent (10 per-

cent adjusted for currency) in 2007 versus the prior year. Information

Management software enables clients to leverage Information on

Demand. The acquisition of FileNet, in the fourth quarter of 2006,

contributed strong revenue growth throughout the year. The Cognos

acquisition, completed in the first quarter of 2008, will provide a

strong entry in the Business Intelligence marketplace and is expected

to provide synergies in software, services, servers and storage.

Lotus revenue increased 8.7 percent (4 percent adjusted for cur-

rency) in 2007 driven by the Notes/Domino family of products.

Lotus software is well established as a tool for providing improved

workplace collaboration and productivity. Lotus Connections,

released in the second quarter, has been rapidly adapted by customers.

The latest version of Lotus Notes, Lotus Notes 8.0, was delivered in

the third quarter of 2007.

Revenue from Tivoli software, infrastructure software that enables

clients to centrally manage networks including security and storage

capability, increased 18.0 percent (13 percent adjusted for currency)

with double-digit growth in each segment of the portfolio, Systems

Management, Security and Storage. The acquisitions of MRO, in the

fourth quarter of 2006, and Vallent and Consul, in the first quarter

of 2007, also contributed to the brand’s revenue growth.

Rational revenue increased 13.7 percent (9 percent adjusted for

currency) in 2007 which reflected strong customer acceptance of the

integrated product set. Rational provides integrated tools to improve

the software development process for clients. The closing of the

Telelogic acquisition is conditioned upon satisfactory completion of

regulatory reviews in the European Union. Telelogic’s suite of system

programming tools complements Rational’s IT tool set, providing a

complete tooling solution across a client’s enterprise.

Revenue from Other middleware products increased 3.5 percent

(flat adjusted for currency) in 2007 versus the prior year. This soft-

ware product set includes more mature products which provide a

more stable flow of revenue.

Operating Systems revenue increased 2.0 percent (decreased 2 per-

cent adjusted for currency) in 2007 versus 2006.

Product Lifecycle Management (PLM) revenue decreased 6.4

percent (11 percent adjusted for currency) in 2007 driven by declines

in the Small and Medium Business sector. PLM software helps com-

panies improve their product development processes and their ability

to use product-related information across their businesses.

Other software segment revenue increased 26.7 percent (22 percent

adjusted for currency) versus 2006 reflecting growth in software-related

services, such as consulting and education.

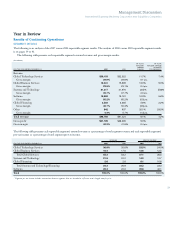

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Software gross profit:

Gross profit $17,015 $15,471 10.0%

Gross profit margin 85.2% 85.2% 0.0 pts.

Software segment gross profit increased 10.0 percent to $17.0 billion

in 2007, driven primarily by strong revenue growth. Gross profit

margin was 85.2 percent in 2007, flat versus the prior year.

The Software segment contributed $6.0 billion of pre-tax profit

in 2007, an increase of 9.3 percent versus 2006. The segment pre-tax

profit margin of 26.8 percent was essentially flat (declined 0.1 pt) ver-

sus the prior year, reflecting the integration of acquired businesses.

Global Financing

See page 51 for an analysis of Global Financing’s revenue and gross

profit.

Geographic Revenue

In addition to the revenue presentation by reportable segment, the

company also measures revenue performance on a geographic basis.