IBM 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ............................................................. 64

A. Significant Accounting Policies ............ 64

B. Accounting Changes ...................................73

C. Acquisitions/Divestitures ............................76

D. Financial Instruments

(excluding derivatives).................................82

E. Inventories ...................................................83

F. Financing Receivables .................................83

G-M ..................................................................84

N-S ...................................................................94

T-W ................................................................102

Note A. Significant Accounting Policies

Basis of Presentation

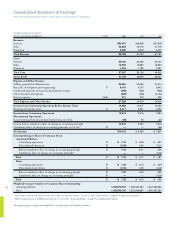

In the first quarter of 2007, the International Business Machines

Corporation (IBM and/or the company) changed the presentation of

revenue and cost in the Consolidated Statement of Earnings to

reflect the categories of Services, Sales and Financing. Previously,

the presentation included Global Services, Hardware, Software,

Global Financing and an Other category. In the past, these categories

were aligned with the company’s reportable segment presentation of

external revenue and cost. However, as the company moves toward

delivering solutions which bring integrated software and services

capabilities to its clients, the alignment between segments and cate-

gories will diverge. Therefore, there are situations where the Global

Services segments could include software revenue, and conversely,

the Software segment may have services revenue. The change was

made to avoid possible confusion between the segment revenue and

cost presentation and the required category presentation in the

Consolidated Statement of Earnings.

The change only impacts the format for the presentation of the

company’s revenue and cost in the Consolidated Statement of

Earnings and does not reflect any change in the company’s reportable

segment results or in the company’s organizational structure. The

periods presented in this Annual Report are reported on a compara-

ble basis. The management discussion and analysis of revenue and

gross profit from continuing operations focuses on the segment view,

as this is how the business is managed and is the best reflection of the

company’s operating results and strategy.

On December 31, 2002, the company sold its hard disk drive

(HDD) business to Hitachi, Ltd. (Hitachi). The HDD business was

part of the Systems and Technology reportable segment. The HDD

business was accounted for as a discontinued operation under account-

ing principles generally accepted in the United States of America

(GAAP) and therefore, the HDD results of operations and cash flows

have been removed from the company’s results of continuing opera-

tions and cash flows for all periods presented in this document.

For 2006, Income from discontinued operations, net of tax, is

related to tax benefits from tax audit settlements. For 2005, the

Loss from discontinued operations, net of tax, is primarily addi-

tional costs associated with parts warranty as agreed upon by the

company and Hitachi.

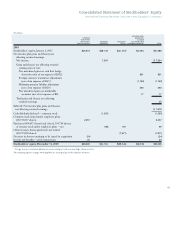

Consolidated Statement of Cash Flows

Subsequent to the company’s Form 10-Q filing on October 30, 2007

for the quarter ended September 30, 2007, it was determined that

“Proceeds from new debt” and “Payments to settle debt” were under-

stated by an equal, offsetting amount of $3,760 million with no

impact on the “Net cash used in financing activities from continuing

operations” section of the Consolidated Statement of Cash Flows for

the nine months ended September 30, 2007.

The company assessed this reporting issue and determined it to

be both qualitatively and quantitatively immaterial with respect to the

overall Consolidated Statement of Cash Flows and the key categories

presented in the statement: Net cash used in operating, investing and

financing activities from continuing operations. In the Consolidated

Statement of Cash Flows for the year ended December 31, 2007 on

page 60, the company has made the adjustments described above. In

2008, the company will present the corrected amounts for the nine

months ended September 30, 2007 in its Form 10-Q for the third

quarter of 2008.

Principles of Consolidation

The Consolidated Financial Statements include the accounts of IBM

and its controlled subsidiaries, which are generally majority owned.

The accounts of variable interest entities (VIEs) as defined by Financial

Accounting Standards Board (FASB) Interpretation No. 46(R),

“Accounting for Variable Interest Entities,” (FIN 46(R)), are included

in the Consolidated Financial Statements, if required. Investments in

business entities in which the company does not have control, but has

the ability to exercise significant influence over operating and financial

policies, are accounted for using the equity method and the company’s

proportionate share of income or loss is recorded in Other (income)

and expense. The accounting policy for other investments in equity

securities is described on page 72 within “Marketable Securities.”

Equity investments in non-publicly traded entities are primarily

accounted for using the cost method. All significant intercompany

transactions and accounts have been eliminated in consolidation.

Use of Estimates

The preparation of Consolidated Financial Statements in conformity

with GAAP requires management to make estimates and assumptions

that affect the amounts of assets, liabilities, revenue, costs, expenses

and gains and losses not affecting retained earnings that are reported

in the Consolidated Financial Statements and accompanying disclo-

sures, including the disclosure of contingent assets and liabilities.

These estimates are based on management’s best knowledge of current

events, historical experience, actions that the company may undertake

in the future and on various other assumptions that are believed to be

reasonable under the circumstances. As a result, actual results may be

different from these estimates. See pages 47 to 49 and page 55 for a

discussion of the company’s critical accounting estimates.