IBM 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

109

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

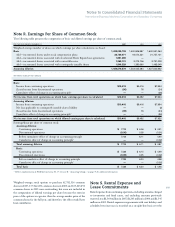

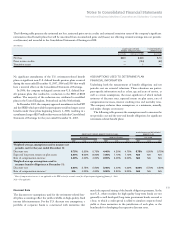

The following table presents the components of net periodic cost of the significant retirement-related benefit plans recognized in Consoli-

dated Statement of Earnings:

($ in millions)

NONPENSION POSTRETIREMENT

SIGNIFICANT DEFINED BENEFIT PENSION PLANS BENEFIT PLAN

U.S. PLAN NON-U.S. PLANS U.S. PLAN

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005 2007 2006 2005 2007 2006 2005

Service cost $ 746 $ 769 $ 682 $ 570 $ 596 $ 694 $ 69 $ 62 $ 45

Interest cost 2,585 2,454 2,463 1,767 1,585 1,635 311 306 324

Expected return on plan assets (3,703) (3,613) (3,672) (2,500) (2,298) (2,245) — — —

Amortization of transition assets — — — (3) (6) (6) — — —

Amortization of prior service costs/(credits) 61 61 61 (125) (108) 8 (62) (62) (62)

Recognized actuarial losses 679 785 567 911 870 578 24 29 25

Plan amendments/curtailments/settlements — — 280 — — 65 — — —

Total net periodic cost $ 368 $ 456 $ 381 $ 620 $ 639 $ 729 $342 $335 $332

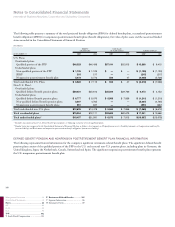

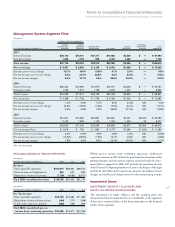

The following table presents the changes in benefit obligations and plan assets of the significant retirement-related benefit plans:

($ in millions)

NONPENSION POSTRETIREMENT

SIGNIFICANT DEFINED BENEFIT PENSION PLANS BENEFIT PLAN

U.S. PLAN NON-U.S. PLANS U.S. PLAN

2007 2006 2007 2006 2007 2006

Change in benefit obligation:

Benefit obligation at beginning of year $46,498 $46,405 $39,454 $36,643 $ 5,773 $ 5,892

Service cost 746 769 570 596 69 62

Interest cost 2,585 2,454 1,767 1,585 311 306

Plan participants’ contributions — — 66 57 — —

Acquisitions/divestitures, net 5 — 85 10 — —

Actuarial losses/(gains) (465) (283) (2,324) (600) (203) 8

Benefits paid from trust (3,046) (2,847) (1,616) (1,454) — —

Direct benefit payments — — (367) (311) (442) (486)

Foreign exchange impact — — 3,177 3,616 — —

Medicare subsidy — — — — (36) (9)

Plan amendments/curtailments/settlements — — 3 (688) — —

Benefit obligation at end of year $46,323 $46,498 $40,815 $39,454 $ 5,472 $ 5,773

Change in plan assets:

Fair value of plan assets at

beginning of year $52,913 $48,542 $37,632 $31,148 $ 47 $ 66

Actual return on plan assets 7,324 7,218 1,468 3,016 15 3

Employer contributions — — 447 1,769 893 438

Acquisitions/divestitures, net — — 52 (78) — —

Plan participants’ contributions — — 66 57 199 185

Benefits paid from trust (3,046) (2,847) (1,616) (1,454) (650) (645)

Foreign exchange impact — — 3,021 3,174 — —

Fair value of plan assets at end of year $57,191 $52,913 $41,070 $37,632 $ 504 $ 47

Funded status at end of year $10,868 $ 6,415 $ 255 $ (1,822) $(4,968) $(5,726)

Accumulated benefit obligation $46,323 $46,421 $39,396 $38,088 N/A N/A

N/A — Not applicable