IBM 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

14

Road Map

The financial section of the International Business Machines Cor-

por ation (IBM or the company) 2007 Annual Report, consisting

of this Manage ment Discussion, the Consolidated Financial

Statements that follow and the notes related thereto, comprises 109

pages of information. This Road Map is designed to provide the

reader with some perspective regarding the information contained

in the financial section.

IBM’s Business Model

The company’s business model is built to support two principal

goals: helping clients succeed in delivering business value by becom-

ing more innovative, efficient and competitive through the use of

business insight and information technology (IT) solutions; and,

providing long-term value to shareholders. The business model has

been developed over time through strategic investments in capabilities

and technologies that have the best long-term growth and profit-

ability prospects based on the value they deliver to clients. The

company’s strategy is to focus on the high-growth, high-value seg-

ments of the IT industry.

The company’s global capabilities include services, software,

hardware, fundamental research and financing. The broad mix of

businesses and capabilities are combined to provide business insight

and solutions for the company’s clients.

The business model is flexible, and allows for periodic change

and rebalancing. The company has exited commoditizing businesses

like personal computers and hard disk drives, and strengthened its

position through strategic investments and acquisitions in emerging

higher value segments like service oriented architecture (SOA) and

Information on Demand. In addition, the company has transformed

itself into a globally integrated enterprise which has improved overall

productivity and is driving investment and participation in the

world’s fastest growing markets. As a result, the company is a higher-

performing enterprise today than it was several years ago.

The business model, supported by the company’s long-term

financial model, enables the company to deliver consistently strong

earnings, cash flows and returns on invested capital in changing eco-

nomic environments.

Transparency

Transparency is a primary goal of successful financial reporting.

The following are several key points for the reader of this year’s

Annual Report.

U The company, in accordance with Section 404 of the Sarbanes-Oxley Act

of 2002, conducted an evaluation of its internal control over financial

reporting and concluded that the internal control over financial reporting

was effective as of December 31, 2007.

U The Management Discussion is designed to provide readers with a view

of the company’s results and certain factors that may affect future pros-

pects from the perspective of the company’s management. Within the

“Management Discussion Snapshot,” on pages 16 and 17, the key mes-

sages and details will give readers the ability to quickly assess the most

important drivers of performance within this brief overview.

U In the first quarter of 2007, the company changed the presentation of

revenue and cost in the Consolidated Statement of Earnings to reflect the

categories of Services, Sales and Financing. Previously, the presentation

included Global Services, Hardware, Software, Global Financing and an

Other category. In the past, these categories were aligned with the com-

pany’s reportable segment presentation of external revenue and cost.

However, as the company moves toward delivering solutions which bring

integrated software and services capabilities to its clients, the alignment

between segments and categories will diverge. Therefore, there are situ-

ations where the Global Services segments could include software revenue,

and conversely, the Software segment may have services revenue. The

change was made to avoid possible confusion between the segment revenue

and cost presentation and the required category presentation in the

Consolidated Statement of Earnings. The change only impacts the format

for the presentation of the company’s revenue and cost in the Consolidated

Statement of Earnings and does not reflect any change in the company’s

reportable segment results or in the company’s organizational structure.

The periods presented in this Annual Report are reported on a comparable

basis. The Management Discussion and Analysis of revenue and gross

profit from continuing operations will focus on the segment view, as this

is how the business is managed and is the best reflection of the company’s

operating results and strategy.

U On January 29, 2008, IBM International Group Capital LLC, an

indirect, wholly owned subsidiary of the company, issued $3.5 billion of

18-month floating rate notes. The proceeds will be utilized to reduce the

364-day bridge loan associated with the 2007 accelerated share repur-

chase (ASR). (See pages 31 and 32 for additional information.) In the

Consolidated Statement of Financial Position included in the company’s

press release and Form 8-K filing on January 17, 2008, the company

classified the $3.5 billion related to the 364-day bridge loan as Short-term

debt. As a result of this refinancing in January, and consistent with the

Management Discussion ............................ 14

Road Map.................................................... 14

Forward-Looking and

Cautionary Statements ............................... 15

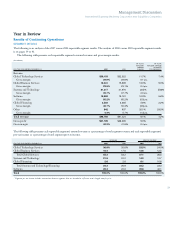

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64