IBM 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

38

Continuing Operations

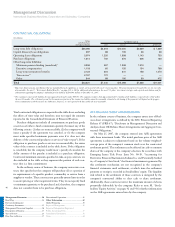

The company’s 2006 performance was the result of a series of actions

taken over the last several years to steadily transform the company.

The company has divested of businesses that are commoditizing, while

investing in targeted acquisitions to continue to build capabilities in

higher value areas. The company has also been focused on increasing

productivity, to expand margins and improve efficiency. In addition,

it has accelerated its move to become a globally integrated company.

These actions have resulted in a more balanced mix of businesses and a

stronger, more competitive and sustainable global business. The com-

pany’s 2006 financial results reflected this improved business model.

The company divested its Personal Computing business on April

30, 2005. Therefore, the reported results for 2006 did not include any

activity for the Personal Computing Division, while the results for

2005 included four months of activity. This lack of comparable periods

had a material impact on the company’s reported revenue growth.

Total revenue, as reported, increased 0.3 percent versus 2005;

excluding the Personal Computing business external revenue from

2005, total 2006 revenue increased 3.6 percent (3.2 percent adjusted

for currency). Pre-tax income from continuing operations grew 8.9

percent, while diluted earnings per share from continuing operations

increased 23.4 percent compared to 2005. Income from continuing

operations increased 17.8 percent compared to 2005, benefiting from

a 5.3 point improvement in the effective tax rate year to year.

The increased revenue, excluding the Personal Computing busi-

ness, in 2006 as compared to 2005, was primarily due to:

U Improved demand in the Software business, driven by Key Branded

Middleware products, with positive contributions from key acquisitions;

U Increased demand in the Systems and Technology business driven by Micro-

electronics, System z and Storage; growth in System x and Retail Store

Solutions; and

U Continued growth in the emerging countries, Brazil, Russia, India and

China, (up 21 percent) and solid performance in the Americas and

EMEA geographies.

The increased income from continuing operations before income

taxes in 2006 as compared to 2005 was primarily due to:

U Revenue growth in the Software segment as discussed above;

U Continued execution of the company’s productivity initiatives driving

improved Global Services gross margins; and

U Revenue growth and continued operational improvement in the Micro-

electronics business.

Total revenue, as reported, increased 0.3 percent (flat adjusted for

currency) versus 2005. From a geographic perspective, as-reported

revenue performance was mixed in 2006 compared to 2005, with

growth in the Americas and EMEA, being offset by decreased reve-

nue in Asia Pacific.

Americas’ revenue increased 1.8 percent (1 percent adjusted for

currency) in 2006 versus 2005 and increased in all regions with the

U.S. up 1.0 percent, Canada 2.4 percent (decreased 4 percent adjusted

for currency) and Latin America 8.6 percent (3 percent adjusted

for currency).

EMEA revenue increased 0.2 percent on an as-reported basis

(declined 1 percent adjusted for currency) in 2006 when compared to

2005. In the major countries, the U.K. increased 0.5 percent (decreased

1 percent adjusted for currency), France increased 1.6 percent (flat

adjusted for currency), Italy increased 1.6 percent (flat adjusted for

currency) and Spain increased 2.1 percent (flat adjusted for cur-

rency). Revenue in Germany declined 2.8 percent (4 percent adjusted

for currency) year to year.

Asia Pacific revenue declined 5.7 percent (3 percent adjusted for

currency) year over year. Japan, which represented over 50 percent of

the Asia Pacific revenue base, declined 10.1 percent (5 percent adjusted

for currency). The Japan revenue decline was partially offset by

increased revenue in Korea (12.6 percent) and India (22.9 percent).

The emerging countries of Brazil, Russia, India and China

together grew 9.9 percent (5 percent adjusted for currency) as the

company continued to invest to build capabilities in these countries.

Brazil grew 15.4 percent (4 percent adjusted for currency), Russia

increased 13.9 percent (14 percent adjusted for currency) and India

increased 22.9 percent (26 percent adjusted for currency). China

declined 0.3 percent (2 percent adjusted for currency) as performance

was significantly impacted by the Personal Computing divestiture.

OEM revenue increased 17.9 percent (18 percent adjusted for

currency) in 2006 driven by strong demand for game processors in

the Microelectronics business.

The company believes that a more appropriate revenue analysis is

one that excludes the revenue results of the Personal Computing

Division in 2005 because it presents results on a comparable basis

and provides a more meaningful focus on the company’s ongoing

operational performance.

Total revenue, excluding the divested Personal Computing busi-

ness, increased 3.6 percent (3.2 percent adjusted for currency) versus

2005. Adjusted for currency, revenue increased in all geographic

markets with the strongest growth coming from the Americas.

Americas’ revenue grew 4.7 percent as reported (4 percent

adjusted for currency), with growth in all regions. From a product

perspective, the increased revenue was driven by software. Latin

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review .................................. 37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64