IBM 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

42

FINANCIAL POSITION

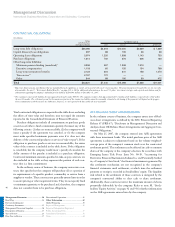

Total assets of $103,234 million declined $2,514 million ($6,223 mil-

lion adjusted for currency) primarily due to lower prepaid pension

assets and a decrease in Cash and cash equivalents. These decreases

were partially offset by increases in Goodwill, long-term deferred tax

assets, Marketable Securities, trade receivables, financing receivables

and Intangible Assets.

Total liabilities of $74,728 million increased $2,078 million (down

$362 million adjusted for currency) primarily driven by Compensation

and benefits, Deferred income and Accounts payable. Partially off-

setting those increases were decreases in long-term deferred tax and

restructuring liabilities.

Stockholders’ equity decreased $4,592 million to $28,506 million

primarily driven by retirement-related charges and net common

stock transactions, partially offset by increased Retained earnings.

The retirement-related driven decrease in Stockholders’ equity and

the decrease in prepaid pension assets were a result of the adoption

of SFAS No. 158 in 2006.

The company generated $15,019 million in cash flow provided by

operating activities, an increase of $105 million compared to 2005.

The increase was primarily driven by increased Net income ($1,559

million), lower pension funding in 2006 ($549 million) and an

increase in cash driven by Accounts payable ($891 million) primarily

resulting from the divestiture of the Personal Computing business in

2005. These increases were partially offset by growth in accounts

receivable ($2,731 million) primarily driven by asset growth in

Global Financing and a decrease in cash related to deferred income

taxes ($461 million), due to utilization of tax credit carryforwards in

2005. Net cash used in investing increased $7,126 million versus

2005 primarily due to net purchases of marketable securities and

other investments ($2,668 million), increased spending on acquisitions

($2,316 million), increased net capital spending ($1,210 million) and

a decline in divestiture-related cash proceeds ($932 million). Net

cash used in financing activities increased $1,057 million primarily

due to higher dividend payments ($434 million) and increased net

cash used to retire debt ($730 million).

Discontinued Operations

On December 31, 2002, the company sold its HDD business to

Hitachi for approximately $2 billion. The final cash payment of $399

million was received on December 30, 2005. In addition, the com-

pany paid Hitachi $80 million to settle warranty obligations during

2005. These transactions were consistent with the company’s previous

estimates. The HDD business was accounted for as a discontinued

operation whereby the results of operations and cash flows were

removed from the company’s results from continuing operations for

all periods presented.

In 2006, the company reported net income of $76 million, net of

tax, primarily related to tax benefits from tax audit settlements. The

company incurred a loss from discontinued operations of $24 million

in 2005, net of tax. This loss was primarily due to additional costs

associated with parts warranty as agreed upon by the company and

Hitachi, under the terms of the agreement for the sale of the HDD

business to Hitachi.

Other Information

Looking Forward

Looking forward, the company enters 2008 in an excellent opera-

tional and financial position.

The company has a significant global presence, operating in 170

countries, with approximately 63 percent of its revenue generated

outside the U.S. In addition, approximately 69 percent of the com-

pany’s employees are located outside the United States, including

about 35 percent in Asia Pacific. This global reach gives the company

access to markets, with well-established organizations and manage-

ment systems who understand the clients and their challenges and

who can respond to these opportunities with value-add solutions.

The company’s transformation to a globally integrated enterprise

provides the capabilities to service clients globally and deliver the

best skills and cost from anywhere in the world.

In emerging markets, the company will continue to invest for

revenue growth and leadership. The company is focused on identi-

fying growth opportunities and following a disciplined investment

policy to capitalize on these opportunities. The company has had

good success in the emerging markets of Brazil, Russia, India and

China. In addition, there are additional opportunities around

the world that are growing at a rapid rate; countries and markets

within Southeast Asia, Eastern Europe, the Middle East and Latin

America that have market growth rates greater than the global

average. Through its investments, the company has developed

extensive capabilities in emerging countries to capture these growth

opportunities. In 2008, the company will also implement a new

organization and management structure that will focus on these

emerging nations and markets.

The company is a proven infrastructure provider of IT technology.

Through its history, the company has built the infrastructure in most

countries that are now considered to have “mature” economies. This

track record will enable the company to capture opportunities in

new, expanding markets worldwide. The company’s broad product

and services portfolio delivers value to clients — through a combina-

tion of services, hardware and software. The portfolio is focused on

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review .................................. 37

Discontinued Operations ........................... 42

Other Information...................................... 42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64