IBM 2007 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Ì

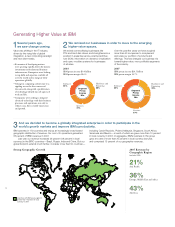

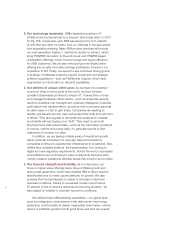

Key Drivers

Revenue growth:

We maintain historical revenue

growth through annuity businesses,

global presence and a balanced

business mix.

Margin expansion:

We focus on delivering higher

value to clients and on increasing

productivity, to improve profitability.

Share repurchases:

Our strong cash generation lets us

return value to shareholders by

reducing shares outstanding while

reinvesting for future growth.

Growth initiatives and future

acquisitions:

We invest in key growth initia-

tives and strategic acquisitions to

complement and scale our product

portfolio.

Retirement-related savings:

We expect to achieve retirement-

related cost savings over the next

several years, driven in part by

Plan redesigns.

14%-16%

EPS CGR

(2006-2010)

0

2

4

6

$8

6.06

06

4.91

05

4.39

04

3.76

03 07

7.18

0

6

4

2

8

10

$12

06

6.06

07

7.18

08 09 10

10

11

12% - 15% CGR

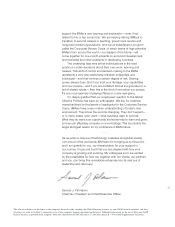

18%

Reinvested

$30 billion

Acquisitions and

Capital Expenditures

Returned to

Shareholders

$53 billion

Share Repurchases

and Dividends

More than

$83 billion

since 2003

As a result, IBM is a higher-performing enterprise

today than it was a decade ago.

Our business model is more aligned with our clients’ needs and generates better

financial results.

4

In May 2007 we shared with investors our 2010 Earnings Per Share

Roadmap — which explains how we expect to achieve EPS growth of

14 to 16 percent and $10 to $11 in earnings per share by 2010. We did

so to give our shareholders a clear understanding of the key factors

driving IBM’s long-term financial objectives. In 2007 we made progress

toward our 2010 objectives by growing earnings per share 18 percent.

This gives us confidence that we can achieve our long-term

financial objectives.

6

That has enabled us to invest in

future sources of growth and

provide record return to investors …

Primary Uses of Cash over

the Past Five Years

5

… while continuing to invest in

R&D — more than $29 billion

over the past five years.

2010 Earnings Per Share Roadmap

We have achieved record

earnings per share …

Pretax earnings from continuing

operations were $14.5 billion, an

increase of 9 percent. Diluted earnings

per share were $7.18, up 18 percent,

marking 20 straight quarters of

growth and five consecutive years

of double-digit growth.

Earnings Per Share

(from continuing operations)

… and record cash

performance.

In 2007 our net cash from operations,

excluding the year-to-year change

in Global Financing receivables,

was $17.4 billion — an increase of

$2.1 billion from last year.

Net Cash from Operations,

Excluding Global Financing

Receivables

($ in billions)

0

2

4

6

8

10

12

14

16

$18

03

12.6

04

12.9

05

13.1

06

15.3

07

17.4