IBM 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

24

Global Services

The company’s Global Services segments, Global Technology

Services and Global Business Services had a combined revenue of

$54,144 million, an increase of 12.1 percent (8 percent adjusted for

currency) in 2007 when compared to 2006. The Global Services seg-

ments delivered combined pre-tax profit of $5,622 million, an

increase of 12.6 percent versus the prior year. The company has

made considerable progress implementing its strategies across the

Global Services offerings. These actions have resulted in improved

financial performance with strong and balanced contribution across

all geographies and business lines.

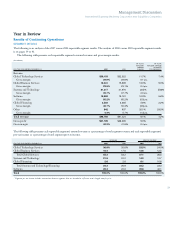

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Global Services revenue: $54,144 $48,291 12.1%

Global Technology Services $36,103 $32,322 11.7%

Strategic Outsourcing 18,701 17,044 9.7

Integrated Technology Services 8,438 7,448 13.3

Business Transformation

Outsourcing 2,294 1,845 24.4

Maintenance 6,670 5,986 11.4

Global Business Services $18,041 $15,969 13.0%

Global Technology Services (GTS) revenue increased 11.7 percent

(7 percent adjusted for currency) in 2007 versus 2006. The strong

performance reflects the extensive transformation which has occurred

in this business over the past few years. This transformation included

revamping the entire Integrated Technology Services (ITS) portfolio,

continued improvement in Strategic Outsourcing (SO) delivery and

a disciplined approach to driving new business in existing accounts.

Total signings in GTS increased 2 percent, with shorter term signings

growth of 4 percent and 1 percent growth in longer term signings.

SO revenue was up 9.7 percent (5 percent adjusted for currency)

with growth in all geographies, led by Europe/Middle East/Africa

(EMEA) and Asia Pacific. Revenue growth benefited from prior-year

signings, sales of new business in existing accounts, lower base con-

tract erosion and good yield from 2007 signings. SO signings in 2007

decreased 1 percent when compared to 2006.

ITS revenue increased 13.3 percent (9 percent adjusted for cur-

rency) in 2007 versus 2006. Revenue growth was driven primarily by

increased signings and reflects the strength of the ITS portfolio

worldwide. The revamped ITS portfolio includes 10 Service Product

Lines which complement hardware offerings from Systems and

Technology and software offerings from the Software business. The

acquisition of Internet Security Systems (ISS), in the fourth quarter

of 2006, also contributed to the revenue growth this year. ITS sign-

ings increased 4 percent in 2007, with good performance in the key

offerings, including Green Data Center, Server Management Services

and SOA.

Business Transformation Outsourcing (BTO) revenue increased

24.4 percent (20 percent adjusted for currency), with double-digit

growth in all geographies. BTO signings increased 17 percent year

over year.

Maintenance revenue increased 11.4 percent (7 percent adjusted

for currency) driven primarily by increased availability services on

non-IBM IT equipment. Services provided to InfoPrint Solutions,

following the divestiture of the printer business in the second quar-

ter, contributed 4 points of growth.

Global Business Services (GBS) revenue increased 13.0 percent

(9 percent adjusted for currency) in 2007, with balanced growth across

all three geographies. Revenue performance was led by double-digit

growth in application management services offerings and growth in

all consulting service lines. Total signings in GBS increased 1 percent,

led by 5 percent growth in shorter term signings. Longer term sign-

ings decreased 7 percent year over year.

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Global Services gross profit:

Global Technology Services:

Gross profit $10,800 $9,623 12.2%

Gross profit margin 29.9% 29.8% 0.1 pts.

Global Business Services:

Gross profit $ 4,240 $3,694 14.8%

Gross profit margin 23.5% 23.1% 0.4 pts.

GTS gross profit increased 12.2 percent compared to 2006, with

gross profit margin improving 0.1 points, driven primarily by margin

expansion in SO due to an improved cost structure and ITS, which

benefited from a mix to higher value offerings. Segment pre-tax

profit increased 8.2 percent to $3.6 billion with a pre-tax margin of

9.4 percent, a decline of 0.2 points versus 2006. Increased invest-

ments in sales and delivery, acquisitions and restructuring charges

were essentially offset by productivity improvements and effective

expense management.

Transformation actions executed by GBS over the past two years

have resulted in profitable growth. GBS gross profit increased 14.8

percent to $4.2 billion in 2007 when compared to 2006, and the gross

profit margin improved 0.4 points. Segment pre-tax profit increased

21.0 percent to $2.1 billion with a pre-tax margin of 10.7 percent, an

improvement of 0.9 points year over year. The margin expansion has

been driven primarily by revenue growth, ongoing productivity and

utilization initiatives and expense management.

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ............................................ 23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ..............................................50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64