IBM 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

45

Events that could temporarily change the historical cash flow dynam-

ics discussed on page 44 include significant changes in operating

results, material changes in geographic sources of cash, unexpected

adverse impacts from litigation or future pension funding during

periods of severe and prolonged downturn in the capital markets.

Whether any litigation has such an adverse impact will depend on a

number of variables, which are more completely described on page

96. In January 2008, the company closed the previously announced

Cognos acquisition for approximately $5.0 billion in cash; the

Telelogic acquisition is also expected to close for approximately $0.8

billion following the completion of regulatory reviews. With respect

to pension funding, in the first quarter of 2007, the company made a

$500 million voluntary cash contribution to the U.S. nonpension

postretirement plan, and in the first quarter of 2006, the company

contributed approximately $1 billion to the U.K. pension plan. In

addition, on January 19, 2005, the company contributed $1.7 billion

to the qualified portion of the PPP, a U.S. defined benefit plan. As

highlighted in the Contractual Obligations table on page 46, the com-

pany expects to make legally mandated pension plan contributions to

certain non-U.S. plans of approximately $3.3 billion in the next five

years. The company is not quantifying any further impact from pen-

sion funding because it is not possible to predict future movements

in the capital markets or pension plan funding regulations.

The Pension Protection Act of 2006 (the Act) was enacted into

law in 2006, and, among other things, increases the funding require-

ments for certain U.S. defined benefit plans beginning after December

31, 2007. No mandatory contribution is required for the U.S. defined

benefit plan in 2008.

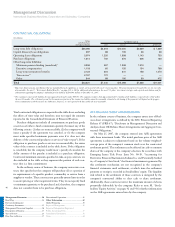

The table below represents the way in which management reviews cash flow as described on page 44.

($ in billions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005 2004 2003

Net cash from operating activities (Continuing Operations) $16.1 $15.0 $14.9 $15.3 $14.5

Less: Global Financing accounts receivable (1.3) (0.3) 1.8 2.5 1.9

Net cash from operating activities (Continuing

Operations), excluding Global Financing receivables 17.4 15.3 13.1 12.9 12.6

Capital expenditures, net (5.0) (4.7) (3.5) (3.7) (3.9)

Free cash flow (excluding Global Financing

accounts receivable) 12.4 10.5 9.6 9.1 8.7

Acquisitions (1.0) (3.8) (1.5) (1.7) (1.8)

Divestitures 0.3 — 0.9 — 0.1

Share repurchase (18.8) (8.1) (7.7) (7.1) (4.3)

Dividends (2.1) (1.7) (1.2) (1.2) (1.1)

Non-Global Financing debt 10.9 (1.1) 1.2 0.7 (0.9)

Other (includes Global Financing accounts

receivable and Global Financing debt) 3.8 1.1 1.9 3.1 1.0

Change in cash, cash equivalents

and short-term marketable securities $ 5.5 $ (3.0) $ 3.1 $ 2.9 $ 1.7