IBM 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

50

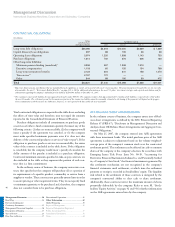

Employees and Related Workforce

YR.- TO -Y R. CHANGE

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005 2007-06 2006-05

IBM/wholly owned subsidiaries 386,558 355,766 329,373 8.7% 8.0%

Less-than-wholly owned subsidiaries 11,769 10,720 12,377 9.8 (13.4)

Complementary 28,642 28,063 24,595 2.1 14.1

In 2007, total employees at IBM and its wholly owned subsidiaries

increased 30,792 compared with 2006. The U.S. remained the larg-

est country, with 121,000 employees, down modestly versus 2006 due

to the Printer divestiture, while resources increased in Asia Pacific,

EMEA and Latin America. The company continues to invest in

Global Services and Software through a combination of hiring and

acquisitions. The company also continues to rebalance its workforce

globally to improve its global reach and competitiveness and to

reflect the changing geographic mix of its business.

The company has been adding resources aggressively in emerging

markets, particularly in the BRIC countries — Brazil, Russia, India

and China — where employment totals approximately 98,000. India

experienced the largest growth, up 22,200 to approximately 74,000

employees at year end. Higher employment in these countries

reflects growth within these markets, as well as the company’s con-

tinued transformation to a globally integrated enterprise.

The complementary workforce is an approximation of equivalent

full-time employees hired under temporary, part-time and limited-

term employment arrangements to meet specific business needs in a

flexible and cost-effective manner.

Global Financing

Description of Business

Global Financing is a reportable segment that is measured as if it were

a standalone entity. Accordingly, the information presented in this sec-

tion is consistent with this separate company view.

The mission of Global Financing is to generate a strong return

on equity and to facilitate clients’ acquisition of IBM hardware,

software and services.

Global Financing invests in financing assets, manages the associ-

ated risks, and leverages with debt, all with the objective of generating

consistently strong returns on equity. The primary focus on IBM

products and IBM clients mitigates the risks normally associated with

of the financial instruments impacting the results of the sensitivity

analysis are not matched with the offsetting changes in the values of

the items that those instruments are designed to finance or hedge.

The results of the sensitivity analysis at December 31, 2007, and

December 31, 2006, are as follows:

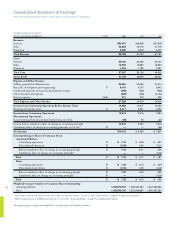

INTEREST RATE RISK

At December 31, 2007, a 10 percent decrease in the levels of interest

rates with all other variables held constant would result in a decrease

in the fair market value of the company’s financial instruments of

$220 million as compared with a decrease of $110 million at

December 31, 2006. A 10 percent increase in the levels of interest

rates with all other variables held constant would result in an increase

in the fair value of the company’s financial instruments of $202 mil-

lion as compared to an increase of $93 million at December 31, 2006.

Changes in the relative sensitivity of the fair value of the company’s

financial instrument portfolio for these theoretical changes in the

level of interest rates are primarily driven by changes in the company’s

debt maturities, interest rate profile and amount.

FOREIGN CURRENCY EXCHANGE RATE RISK

At December 31, 2007, a 10 percent weaker U.S. dollar against for-

eign currencies, with all other variables held constant, would result

in an increase in the fair value of the company’s financial instruments

of $123 million as compared with a decrease of $348 million at

December 31, 2006. Conversely, a 10 percent stronger U.S. dollar

against foreign currencies, with all other variables held constant,

would result in a decrease in the fair value of the company’s financial

instruments of $123 million compared with an increase of $348 mil-

lion at December 31, 2006.

Financing Risks

See the “Global Financing-Description of Business” on pages 50

and 51 for a discussion of the financing risks associated with the

Global Financing business and management’s actions to mitigate

such risks while striving for consistently strong returns on Global

Financing’s equity.

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information...................................... 42

Global Financing ........................................ 50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

Consolidated Statements ..................................58

Notes .................................................................64