IBM 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

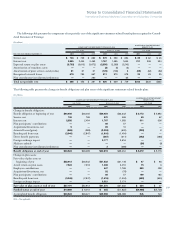

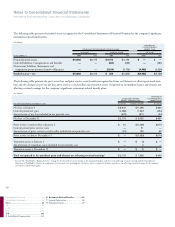

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

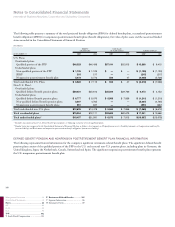

EXERCISES OF EMPLOYEE STOCK OPTIONS

The total intrinsic value of options exercised during the years ended

December 31, 2007, 2006 and 2005 was $1,414 million, $727 million

and $470 million, respectively. The total cash received from employees

as a result of employee stock option exercises for the years ended

December 31, 2007, 2006 and 2005 was approximately $3,619 mil-

lion, $1,149 million and $550 million, respectively. In connection

with these exercises, the tax benefits realized by the company for the

years ended December 31, 2007, 2006 and 2005 were $481 million,

$242 million and $148 million, respectively.

The company settles employee stock option exercises primarily

with newly issued common shares and, occasionally, with treasury

shares. Total treasury shares held at December 31, 2007 and 2006 were

approximately 672 million and 502 million shares, respectively.

STOCK AWARDS

In addition to stock options, the company grants its employees stock

awards. These awards are made in the form of Restricted Stock Units

(RSUs), including Retention Restricted Stock Units (RRSUs), or

Performance Stock Units (PSUs). RSUs are stock awards granted to

employees that entitle the holder to shares of common stock as the

award vests, typically over a two- to five-year period. The fair value

of the awards is determined and fixed on the grant date based on the

company’s stock price. During the year ended December 31, 2006,

the company modified its equity compensation plans to increase

awards of RSUs compared to stock options. RSUs awarded during the

year ended December 31, 2005 were not material when compared to

the value of stock options awarded during that year.

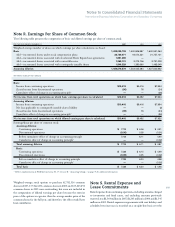

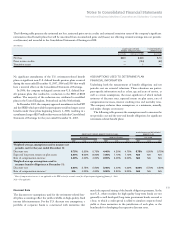

The following table summarizes RSU activity under the Plans

during the years ended December 31, 2007 and 2006:

The shares under option at December 31, 2007 were in the following exercise price ranges:

OPTIONS OUTSTANDING

WTD. AVG.

WTD. AVG. NUMBER AGGREGATE REMAINING

EXERCISE OF SHARES INTRINSIC CONTRACTUAL

EXERCISE PRICE RANGE PRICE UNDER OPTION VALUE LIFE (IN YEARS)

$34 – $60 $ 51 3,535,698 $ 200,389,187 —*

$60 – $85 77 31,399,013 987,276,354 5

$85 – $105 98 64,129,462 648,821,490 5

$105 and over 117 58,597,084 37,137,467 3

$100 157,661,257 $1,873,624,498 4

OPTIONS EXERCISABLE

WTD. AVG.

WTD. AVG. NUMBER AGGREGATE REMAINING

EXERCISE OF SHARES INTRINSIC CONTRACTUAL

EXERCISE PRICE RANGE PRICE UNDER OPTION VALUE LIFE (IN YEARS)

$34 – $60 $ 51 3,535,698 $ 200,389,187 —*

$60 – $85 76 29,754,378 945,466,395 5

$85 – $105 98 53,103,839 542,234,878 4

$105 and over 117 57,698,254 35,220,308 3

$100 144,092,169 $1,723,310,768 4

* Weighted average remaining contractual life is less than one year.

In connection with various acquisition transactions, there were an additional 2.1 million options outstanding at December 31, 2007, as a result of

the company’s assumption of options granted by the acquired entities. The weighted-average exercise price of these options was $79 per share.

Management Discussion ..................................14

Consolidated Statements ..................................14

Notes ........................................................... 64

A-F ...................................................................64

G-M ..................................................................84

N-S ...................................................................94

T-W ........................................................... 102

T. Stock-Based Compensation ................ 102

U. Retirement-Related Benefits .............. 105

V. Segment Information ................................116

W. Subsequent Events ....................................119