IBM 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

52

Financial Condition

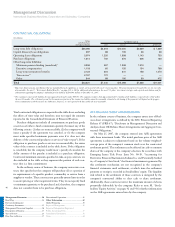

BALANCE SHEET

($ in millions)

AT DECEMBER 31: 2007 2006

Cash $ 755 $ 879

Net investment in sales-type leases 10,876 10,108

Equipment under operating leases:

External clients

(a) 2,401 2,264

Internal clients

(b) (c) 1,872 1,976

Client loans 10,667 9,267

Total client financing assets 25,816 23,615

Commercial financing receivables 6,375 5,844

Intercompany financing receivables

(b) (c) 2,984 2,534

Other receivables 368 327

Other assets 1,288 746

Total financing assets $37,586 $33,945

Intercompany payables

(b) $ 6,934 $ 5,858

Debt

(d) 24,532 22,287

Other liabilities 2,672 2,590

Total financing liabilities 34,138 30,735

Total financing equity 3,448 3,211

Total financing liabilities and equity $37,586 $33,945

(a) Includes intercompany mark-up, priced on an arms-length basis, on products purchased

from the company’s product divisions, which is eliminated in IBM’s consolidated results.

(b) Entire amount eliminated for purposes of IBM’s consolidated results and therefore does

not appear on page 59.

(c) These assets, along with all other financing assets in this table, are leveraged at the value

in the table using Global Financing debt.

(d) Global Financing debt is comprised of intercompany loans and external debt. A portion

of Global Financing debt is in support of the company’s internal business, or related to

intercompany mark-up embedded in the Global Financing assets. See table on page 54.

SOURCES AND USES OF FUNDS

The primary use of funds in Global Financing is to originate client

and commercial financing assets. Client financing assets for end users

consist primarily of IBM hardware, software and services, but also

include non-IBM equipment, software and services to meet IBM cli-

ents’ total solutions requirements. Client financing assets are primarily

sales type, direct financing, and operating leases for equipment, as

well as loans for hardware, software and services with terms generally

for two to seven years. Global Financing’s client loans are primarily

for software and services and are unsecured. These loans are subjected

to additional credit analysis in order to mitigate the associated risk.

Loan agreements include credit protective language and dollar limits

on how much can be financed in order to minimize credit risk. Client

financing also includes internal activity as described on page 51.

Commercial financing receivables arise primarily from inventory

and accounts receivable financing for dealers and remarketers of IBM

and non-IBM products. Payment terms for inventory financing and

accounts receivable financing generally range from 30 to 90 days. These

short-term receivables are primarily unsecured and are also subject to

additional credit actions in order to mitigate the associated risk.

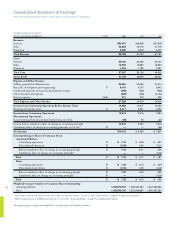

ORIGINATIONS

The following are total external and internal financing originations.

($ in millions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

Client financing:

External $14,171 $13,087 $12,249

Internal 1,040 1,214 1,167

Commercial financing 30,541 27,969 27,032

Total $45,752 $42,270 $40,448

New financing originations exceeded cash collections for both client

and commercial financing in 2007, which resulted in a net increase in

financing assets from December 31, 2006. The increase in originations

in 2007 from 2006, as well as the increase in 2006 versus 2005, was

due to improving volumes in both client and commercial financing.

Cash generated by Global Financing in 2007 was deployed to pay

intercompany payables and dividends to IBM as well as to reduce

intercompany debt.

GLOBAL FINANCING RECEIVABLES AND ALLOWANCES

The following table presents external financing receivables, excluding

residual values, and the allowance for doubtful accounts.

($ in millions)

AT DECEMBER 31: 2007 2006

Gross financing receivables $27,642 $24,926

Specific allowance for doubtful accounts 230 294

Unallocated allowance for doubtful accounts 138 76

Total allowance for doubtful accounts 368 370

Net financing receivables $27,274 $24,556

Allowance for doubtful account coverage 1.3% 1.5%

Management Discussion ............................ 14

Road Map .........................................................14

Forward-Looking and

Cautionary Statements .....................................15

Management Discussion Snapshot ..................16

Description of Business ....................................17

Year in Review ..................................................23

Prior Year in Review ........................................37

Discontinued Operations .................................42

Other Information ............................................42

Global Financing ........................................ 50

Report of Management ....................................56

Report of Independent Registered

Public Accounting Firm ...................................57

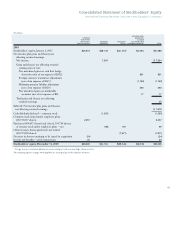

Consolidated Statements ..................................58

Notes .................................................................64