IBM 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

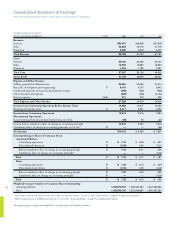

($ in millions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

Cash Flow from Operating Activities from Continuing Operations:

Net income $ 10,418 $ 9,492 $ 7,934

Loss/(income) from discontinued operations 00 (76) 24

Adjustments to reconcile income from continuing operations

to cash provided by operating activities:

Depreciation 4,038 3,907 4,147

Amortization of intangibles 1,163 1,076 1,041

Stock-based compensation 713 846 1,043

Deferred income taxes 740 1,724 2,185

Net gain on asset sales and other (89) (175) (1,525)

Change in operating assets and liabilities, net of acquisitions/divestitures:

Receivables (including financing receivables) (1,408) (512) 2,219

Retirement related (228) (850)* (1,728)*

Inventories 182 112 202

Other assets/other liabilities 706 (881)** (91)**

Accounts payable (142) 355 (536)

Net Cash Provided by Operating Activities from Continuing Operations 16,094 15,019 14,914

Cash Flow from Investing Activities from Continuing Operations:

Payments for plant, rental machines and other property (4,630) (4,362) (3,842)

Proceeds from disposition of plant, rental machines and other property 537 430 1,107

Investment in software (875) (804) (792)

Purchases of marketable securities and other investments (30,449) (28,555) (4,526)

Proceeds from disposition of marketable securities and other investments 31,441 25,542 4,180

Divestiture of businesses, net of cash transferred 310 — 932

Acquisition of businesses, net of cash acquired (1,009) (3,799) (1,482)

Net Cash Used in Investing Activities from Continuing Operations (4,675) (11,549) (4,423)

Cash Flow from Financing Activities from Continuing Operations:

Proceeds from new debt*** 21,744 1,444 4,363

Short-term borrowings/(repayments) less than 90 days — net 1,674 1,834 (232)

Payments to settle debt*** (11,306) (3,400) (3,522)

Common stock repurchases+ (18,828) (8,084) (7,739)

Common stock transactions — other+ 4,123 1,685 1,233

Cash dividends paid (2,147) (1,683) (1,250)

Net Cash Used in Financing Activities from Continuing Operations (4,740) (8,204) (7,147)

Effect of exchange rate changes on cash and cash equivalents 294 201 (789)

Net cash used in discontinued operations from: Operating activities (5) (12) (40)

Net change in cash and cash equivalents 6,969 (4,546) 2,515

Cash and cash equivalents at January 1 8,022 12,568 10,053

Cash and Cash Equivalents at December 31 $ 14,991 $ 8,022 $12,568

Supplemental Data:

Income taxes paid — net of refunds received $ 2,608 $ 2,068 $ 1,994

Interest paid on debt $ 1,485 $ 1,202++ $ 973++

Capital lease obligations $ 57 $ 36 $ 287

Equity securities received as divestiture consideration+++ $ — $ — $ 430

* Reclassified to conform with 2007 presentation combining Pension assets and Pension liabilities into one caption — Retirement related.

** Reclassified to conform with 2007 presentation to combine Other than temporary declines in securities and other investments and the Other assets/other liabilities into one caption.

*** See note A, “Consolidated Statement of Cash Flows,” on page 64 for additional information.

+ Reclassified to conform with 2007 presentation of the new Common stock repurchases and Common stock transactions — other previously combined in Common stock transactions — net.

++ Reclassified to conform with 2007 presentation of disclosing interest paid on debt versus total interest paid including net investment hedging activity.

+++ Lenovo equity valued at $542 million net of lock-up provisions of $112 million. See note C, “Acquisitions/Divestitures,” on page 81 for additional information.

The accompanying notes on pages 64 through 119 are an integral part of the financial statements.

Consolidated Statement of Cash Flows

International Business Machines Corporation and Subsidiary Companies