IBM 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

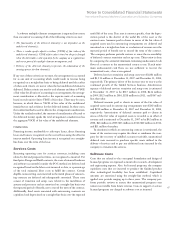

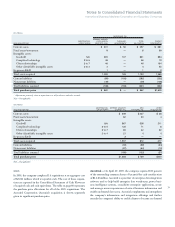

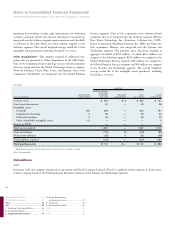

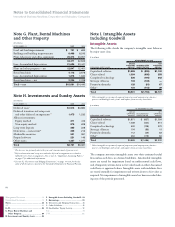

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ............................................................. 64

A. Significant Accounting Policies ..................64

B. Accounting Changes ............................. 73

C. Acquisitions/Divestitures ............................76

D. Financial Instruments

(excluding derivatives).................................82

E. Inventories ...................................................83

F. Financing Receivables .................................83

G-M ..................................................................84

N-S ...................................................................94

T-W ................................................................102

In December 2007, the FASB issued SFAS No. 141(R), “Business

Combinations,” which will become effective in 2009 via prospective

application to new business combinations. This Statement requires

that the acquisition method of accounting be applied to a broader set

of business combinations, amends the definition of a business com-

bination, provides a definition of a business, requires an acquirer to

recognize an acquired business at its fair value at the acquisition date

and requires the assets and liabilities assumed in a business combination

to be measured and recognized at their fair values as of the acquisition

date (with limited exceptions). The company will adopt this Statement

in fiscal year 2009 and its effects on future periods will depend on the

nature and significance of any acquisitions subject to this Statement.

In December 2007, the FASB issued SFAS No. 160, “Noncontrol-

ling Interests in Consolidated Financial Statements — an amendment

of ARB No. 51.” This Statement requires that the noncontrolling

interest in the equity of a subsidiary be accounted for and reported as

equity, provides revised guidance on the treatment of net income and

losses attributable to the noncontrolling interest and changes in own-

ership interests in a subsidiary and requires additional disclosures that

identify and distinguish between the interests of the controlling and

noncontrolling owners. Pursuant to the transition provisions of SFAS

No. 160, the company will adopt the Statement in fiscal year 2009 via

retrospective application of the presentation and disclosure require-

ments. The company does not expect the adoption of this Statement

to have a material effect on the Consolidated Financial Statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair

Value Option for Financial Assets and Financial Liabilities, Including

an amendment of FASB Statement No. 115,” which will become

effective in 2008. SFAS No. 159 permits entities to measure eligible

financial assets, financial liabilities and firm commitments at fair

value, on an instrument-by-instrument basis, that are otherwise not

permitted to be accounted for at fair value under other generally

accepted accounting principles. The fair value measurement election

is irrevocable and subsequent changes in fair value must be recorded

in earnings. The company will adopt this Statement in fiscal year

2008 and does not expect the adoption of this Statement to have a

material effect on the Consolidated Financial Statements.

In September 2006, the FASB finalized SFAS No. 157 which will

become effective in 2008 except as amended by FSP FAS 157-1 and

FSP FAS 157-2 as previously described. This Statement defines fair

value, establishes a framework for measuring fair value and expands

disclosures about fair value measurements; however, it does not

require any new fair value measurements. The provisions of SFAS

No. 157 will be applied prospectively to fair value measurements and

disclosures for financial assets and financial liabilities and nonfinancial

assets and nonfinancial liabilities recognized or disclosed at fair value

in the financial statements on at least an annual basis beginning in the

first quarter of 2008. While the company does not expect the adop-

tion of this Statement to have a material impact on its Consolidated

Financial Statements at this time, the company will monitor any

additional implementation guidance that is issued that addresses the

fair value measurements for certain financial assets, such as private

market pension plan assets, and nonfinancial assets and nonfinancial

liabilities not disclosed at fair value in the financial statements on at

least an annual basis.

Standards Implemented

In the first quarter of 2007, the company adopted SFAS No. 156,

“Accounting for Servicing of Financial Assets — an amendment of

FASB Statement No. 140,” that provides guidance on accounting

for separately recognized servicing assets and servicing liabilities.

In accordance with the provisions of SFAS No. 156, separately

recognized servicing assets and servicing liabilities must be initially

measured at fair value, if practicable. Subsequent to initial recogni-

tion, the company may use either the amortization method or the

fair value measurement method to account for servicing assets and

servicing liabilities within the scope of this Statement. The adoption

of this Statement did not have a material effect on the Consolidated

Financial Statements.

In the first quarter of 2007, the company adopted SFAS No. 155,

“Accounting for Certain Hybrid Financial Instruments — an amend-

ment of FASB Statements No. 133 and 140,” which permits fair value

remeasurement for any hybrid financial instrument that contains an

embedded derivative that otherwise would require bifurcation in

accordance with the provisions of SFAS No. 133, “Accounting for

Derivative Instruments and Hedging Activities.” The adoption of

this Statement did not have a material effect on the Consolidated

Financial Statements.

The company adopted FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes — an Interpretation of FASB

Statement No. 109” (FIN 48) on January 1, 2007. FIN 48 clarifies the

accounting and reporting for uncertainties in income tax law. This

Interpretation prescribes a comprehensive model for the financial

statement recognition, measurement, presentation and disclosure of

uncertain tax positions taken or expected to be taken in income tax

returns. See note O, “Taxes,” on pages 97 to 99 for additional infor-

mation, including the effects of adoption on the Consolidated

Statement of Financial Position.