IBM 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

99

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

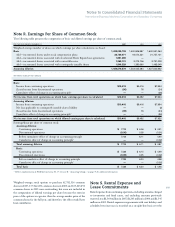

Total pre-tax restructuring activity was as follows:

($ in millions)

PRE-TAX CHARGES LIABILITY LIABILITY

RECORDED IN ASSET RECORDED IN AS OF

SECOND-QTR. 2005 IMPAIRMENTS SECOND-QTR. 2005 PAYMENTS OTHER** DEC. 31, 2005

Workforce reductions $1,574 $ — $1,574 $(1,013) $(107) $454

Vacant space 141 — 141 (53) (5) 83

Asset impairments 95 95 — — — —

Total restructuring activity for

second-quarter 2005 actions $1,810* $95 $1,715 $(1,066) $(112) $537+

* $1,574 million recorded in SG&A expense and $236 million recorded in Other (income) and expense in the Consolidated Statement of Earnings.

** Consists of foreign currency translation adjustments ($38 million), net balance sheet reclassifications ($41 million) and reversals of previously recorded liabilities ($34 million) for changes

in the estimated cost of employee terminations and vacant space, offset by approximately $1 million of accretion expense. The reversals were recorded primarily in SG&A expense.

+ $391 million recorded as a current liability in Accounts payable and accruals and $146 million as a noncurrent liability in Other liabilities in the Consolidated Statement of Financial Position.

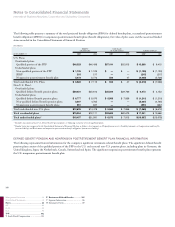

The company has not provided deferred taxes on $18.8 billion of

undistributed earnings of non-U.S. subsidiaries at December 31,

2007, as it is the company’s policy to indefinitely reinvest these earn-

ings in non-U.S. operations. However, the company periodically

repatriates a portion of these earnings to the extent that it does not

incur an additional U.S. tax liability. Quantification of the deferred

tax liability, if any, associated with indefinitely reinvested earnings is

not practicable.

For additional information on the company’s effective tax rate, as

well as the cash tax rate, refer to the “Looking Forward” section of

the Management Discussion on page 43.

Note P. Research, Development

and Engineering

RD&E expense was $6,153 million in 2007, $6,107 million in 2006

and $5,842 million in 2005.

The company incurred expense of $5,754 million in 2007, $5,682

million in 2006 and $5,379 million in 2005 for scientific research and

the application of scientific advances to the development of new and

improved products and their uses, as well as services and their appli-

cation. Within these amounts, software-related expense was $3,037

million, $2,842 million and $2,689 million in 2007, 2006 and 2005,

respectively. In addition, included in the expense was a charge of $7

million and $1 million in 2006 and 2005, respectively, for acquired

in-process R&D.

Expense for product-related engineering was $399 million, $425

million and $463 million in 2007, 2006 and 2005, respectively.

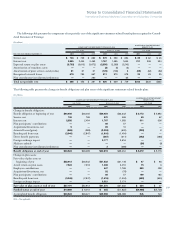

Note Q. 2005 Actions

In May 2005, management announced its plans to implement a series

of restructuring actions designed to improve the company’s efficien-

cies, strengthen its client-facing operations and capture opportunities

in high-growth markets. The company’s actions primarily included

voluntary and involuntary workforce reductions, with the majority

impacting the Global Services segments, primarily in Europe, as

well as costs incurred in connection with the vacating of leased

facilities. These actions were in addition to the company’s ongoing

workforce reduction and rebalancing activities that occur each quar-

ter. The total charges expected to be incurred in connection with all

second-quarter 2005 initiatives is approximately $1,771 million

($1,765 million of which has been recorded cumulatively through

December 31, 2007). Approximately $1,631 million of the total

charges require cash payments, of which approximately $1,453 mil-

lion have been made as of December 31, 2007 and $73 million are

expected to be made over the next 12 months.