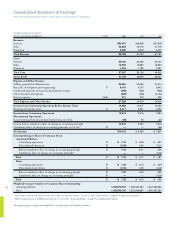

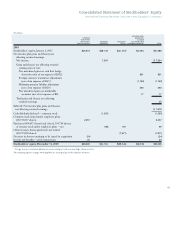

IBM 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

51

a financing company. Global Financing has the benefit of both a deep

knowledge of its client base and a clear insight into the products that

are being leased. This combination allows Global Financing to effec-

tively manage two of the major risks (credit and residual value) that

are normally associated with financing.

Global Financing comprises three lines of business:

U Client financing provides lease and loan financing to end users and inter-

nal clients for terms generally between two and seven years. Internal

financing is predominantly in support of Global Services’ long-term client

service contracts. Global Financing also factors a selected portion of the

company’s accounts receivable, primarily for cash management purposes.

All internal financing arrangements are at arm’s-length rates and are

based upon market conditions.

U Commercial financing provides primarily short-term inventory and

accounts receivable financing to dealers and remarketers of IT products.

U Remarketing sells and leases used equipment to new or existing clients both

externally and internally. This equipment is primarily sourced from the

conclusion of lease transactions. Externally-remarketed equipment reve-

nue represents sales or leases to clients and resellers. Internally-remarketed

equipment revenue primarily represents used equipment that is sold or

leased internally to the System and Technology and Global Services seg-

ments. The System and Technology segment may also sell the equipment

that it purchases from Global Financing to external clients.

In addition to the strength of the economy and its impact on corporate

IT budgets, key drivers of Global Financing’s results are interest

rates and originations. Interest rates directly impact Global Financ-

ing’s business by increasing or decreasing both financing revenue and

the associated borrowing costs. Originations, which determine the

asset base of Global Financing’s annuity-like business, are impacted

by IBM’s non-Global Financing sales volumes and Global Financing’s

participation rates. Participation rates are the propensity of IBM’s

clients to finance their purchases through Global Financing in lieu of

paying IBM up-front cash or financing through a third party.

Results of Operations

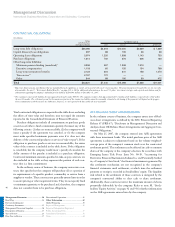

($ in millions)

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

External revenue $2,502 $2,365 $2,401

Internal revenue 1,482 1,527 1,506

Total revenue 3,984 3,892 3,907

Cost 1,819 1,773 1,648

Gross profit $2,165 $2,119 $2,259

Gross profit margin 54.4% 54.5% 57.8%

Pre-tax income $1,386 $1,455 $1,583

After-tax income* $ 877 $ 914 $1,032

Return on equity * 26.1% 29.5% 33.2%

* See page 55 for the details of the After-tax income and Return on equity calculations.

The increase in 2007 revenue, as compared to 2006, was primarily

due to:

U Growth in external revenue of 5.8 percent (2 percent adjusted for cur-

rency) primarily driven by increased used equipment sales (up 12.7 percent

to $704 million); partially offset by

U A decline in internal revenue of 3.0 percent, due primarily to lower used

equipment sales to the Systems and Technology segment (down 15.7 percent

to $780 million), partially offset by an increase in internal financing

revenue of 16.6 percent to $702 million. The increase in financing rev-

enue was due to higher average asset balances and higher asset yields.

Global Financing gross profit increased 2.2 percent compared to

2006, with gross margin declining 0.1 point. This was due to higher

margin used equipment sales largely offset by margin compression

on financing revenue due to higher borrowing costs.

The decline in 2006 revenue, as compared to 2005 was primarily

due to:

U A decline in external revenue of 1.5 percent (2 percent adjusted for cur-

rency) primarily driven by an 8.3 percent decrease to $625 million in

used equipment sales; partially offset by

U Growth in internal revenue of 1.4 percent driven by an increase in

financing revenue of 10.6 percent to $602 million due to higher average

asset balances and higher asset yields.

Global Financing gross profit decreased 6.2 percent and gross mar-

gin declined 3.3 points in 2006 versus 2005. The decrease in dollars

and gross margin was driven primarily by lower financing margins

due to higher borrowing costs related to the interest rate environ-

ment in 2006, and a decrease in equipment sales.

Global Financing pre-tax income decreased 4.7 percent in 2007

versus 2006, and 8.1 percent in 2006 versus 2005. The decrease in

2007 was driven by an increase of $90 million in accounts receivable

provisions, partially offset by the increase in gross profit of $46 mil-

lion. The decrease in 2006 versus 2005 was primarily driven by the

decrease in gross profit of $140 million. The increase in accounts

receivable provisions in 2007 was primarily due to the increasing size

of the receivables portfolio. Overall coverage rate is 1.3 percent, down

0.2 points versus 2006. (Also see pages 52 and 53 for an additional

discussion of Global Financing receivables and allowances.)

The decrease in return on equity from 2006 to 2007, and from

2005 to 2006 was primarily due to lower pre-tax income.