IBM 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management Discussion

International Business Machines Corporation and Subsidiary Companies

31

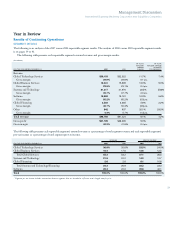

Acquired Intangible Asset Amortization

The company has been investing in targeted acquisitions primarily in

its Software and Global Services segments to increase its capabilities

in higher value market segments. The following table presents the

total acquired intangible asset amortization included in the Consol-

idated Statement of Earnings. See note I, “Intangible Assets Including

Goodwill,” on pages 84 and 85 for additional information.

($ in millions)

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006* CHANGE

Cost:

Software $ 91 $ 81 12.6%

Services 42 12 252.7

Hardware — 3 NM

Selling, general and

administrative expense 234 220 6.7

Total $367 $316 16.3%

* Reclassified to conform with 2007 presentation of Services and Selling, general and

administrative expense categories.

NM — Not meaningful

Income Taxes

The effective tax rate for 2007 was 28.1 percent, compared with 29.3

percent in 2006. The 1.2 point decrease was primarily driven by the

absence of the one-time tax cost associated with the intercompany

transfer of certain intellectual property in the fourth quarter of 2006

(4.3 points) and the absence of the benefit from the settlement of the

U.S. federal income tax audit for the years 2001 through 2003, also in

the fourth quarter of 2006 (3.0 points). The company also benefited

in 2007 from a more favorable mix of income in lower tax rate juris-

dictions and increased capital loss and state credit benefits, offset by a

reduction in certain tax incentives.

Earnings Per Share

Basic earnings per share is computed on the basis of the weighted-

average number of shares of common stock outstanding during the

period. Diluted earnings per share is computed on the basis of the

weighted-average number of shares of common stock plus the effect

of dilutive potential common shares outstanding during the period

using the treasury stock method. Dilutive potential common shares

include outstanding stock options, stock awards, convertible notes

and shares which may be required to settle ASR agreements.

YR.-TO-YR.

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 CHANGE

Earnings per share of common stock:

Assuming dilution:

Continuing operations $ 7.18 $6.06 18.5%

Discontinued operations (0.00) 0.05 NM

Total $ 7.18 $6.11 17.5%

Basic:

Continuing operations $ 7.32 $6.15 19.0%

Discontinued operations (0.00) 0.05 NM

Total $ 7.32 $6.20 18.1%

Weighted-average shares

outstanding (in millions):

Assuming dilution 1,450.6 1,553.5 (6.6)%

Basic 1,423.0 1,530.8 (7.0)%

NM — Not meaningful

Actual shares outstanding at December 31, 2007 and December 31,

2006 were 1,385.2 million and 1,506.5 million, respectively. The

average number of common shares outstanding assuming dilution

was 103.0 million shares lower in 2007 versus 2006. The decrease was

primarily the result of the company’s common share repurchase pro-

gram. See note M, “Stockholders’ Equity Activity,” on pages 92 and

93 for additional information regarding common share activities. Also

see note R, “Earnings Per Share of Common Stock,” on page 101.

FINANCIAL POSITION

Dynamics

The assets and debt associated with the Global Financing business

are a significant part of the company’s financial position. The finan-

cial position amounts appearing below and on pages 32 to 35 are the

consolidated amounts including Global Financing. The amounts

appearing in the separate Global Financing section are supplemen-

tary data presented to facilitate an understanding of the Global

Financing business.

In 2007, the company repurchased $18.8 billion of its outstanding

common stock, of which $12.5 billion was the initial purchase price

of the shares repurchased through ASR agreements. Under the

agreements, which were executed on May 25, 2007, the company

repurchased 118.8 million shares from three banks for an initial price

of $105.18 per share. The banks were expected to purchase an

equivalent number of shares in the open market in the nine month

period following May 25, 2007. As discussed in note M, “Stockholders’

Equity Activity,” on pages 92 and 93, the initial price of the ASR is