IBM 2007 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

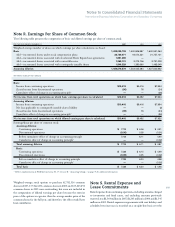

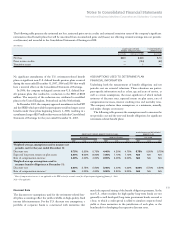

Note R. Earnings Per Share of Common Stock

The following table presents the computation of basic and diluted earnings per share of common stock:

FOR THE YEAR ENDED DECEMBER 31: 2007 2006 2005

Weighted-average number of shares on which earnings per share calculations are based:

Basic 1,423,039,793 1,530,806,987 1,600,591,264

Add — incremental shares under stock compensation plans 22,730,971 18,074,331 21,757,121

Add — incremental shares associated with Accelerated Share Repurchase agreements 1,891,095 — —

Add — incremental shares associated with convertible notes 1,362,191 3,273,706 3,791,228

Add — incremental shares associated with contingently issuable shares 1,546,529 1,380,360 1,493,049

Assuming dilution 1,450,570,579 1,553,535,384 1,627,632,662

($ in millions except per share amounts)

Basic:

Income from continuing operations $10,418 $9,416 $7,994

(Loss)/income from discontinued operations (00) 76 (24)

Cumulative effect of change in accounting principle* — — (36)

Net income from total operations on which basic earnings per share is calculated $10,418 $9,492 $7,934

Assuming dilution:

Income from continuing operations $10,418 $9,416 $7,994

Net loss applicable to contingently issuable shares liability — — (2)

(Loss)/income from discontinued operations (00) 76 (24)

Cumulative effect of change in accounting principle* — — (36)

Net income from total operations on which diluted earnings per share is calculated $10,418 $9,492 $7,932

Earnings/(loss) per share of common stock:

Assuming dilution:

Continuing operations $ 7.18 $ 6.06 $ 4.91

Discontinued operations (0.00) 0.05 (0.01)

Before cumulative effect of change in accounting principle 7.18 6.11 4.90

Cumulative effect of change in accounting principle* — — (0.02)

Total assuming dilution $ 7.18 $ 6.11 $ 4.87

Basic:

Continuing operations $ 7.32 $ 6.15 $ 4.99

Discontinued operations (0.00) 0.05 (0.02)

Before cumulative effect of change in accounting principle 7.32 6.20 4.98

Cumulative effect of change in accounting principle* — — (0.02)

Total basic $ 7.32 $ 6.20 $ 4.96

* Reflects implementation of FASB Interpretation No. 47. See note B, “Accounting Changes,” on page 75 for additional information.

Weighted-average stock options to purchase 62,782,516 common

shares in 2007, 157,942,283 common shares in 2006 and 165,615,293

common shares in 2005 were outstanding, but were not included in

the computation of diluted earnings per share because the exercise

price of the options was greater than the average market price of the

common shares for the full year, and therefore, the effect would have

been antidilutive.

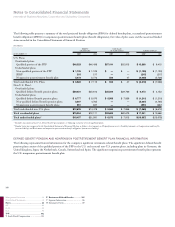

Note S. Rental Expense and

Lease Commitments

Rental expense from continuing operations, including amounts charged

to inventories and fixed assets, and excluding amounts previously

reserved, was $1,364 million in 2007, $1,263 million in 2006 and $1,345

million in 2005. Rental expense in agreements with rent holidays and

scheduled rent increases is recorded on a straight-line basis over the