IBM 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

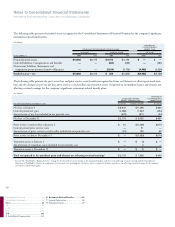

Healthcare Cost Trend Rate

For nonpension postretirement benefit plan accounting, the com-

pany reviews external data and its own historical trends for healthcare

costs to determine the healthcare cost trend rates. However, the

healthcare cost trend rate has an insignificant effect on plan costs and

obligations as a result of the terms of the plan which limit the com-

pany’s obligation to the participants. The company assumes that the

healthcare cost trend rate for 2008 will be 8 percent. In addition, the

company assumes that the same trend rate will decrease to 5 percent

over the next six years. A one percentage point increase or decrease

in the assumed healthcare cost trend rate would not have a material

effect on the 2007, 2006 and 2005 net periodic cost or the benefit

obligations as of December 31, 2007 and 2006.

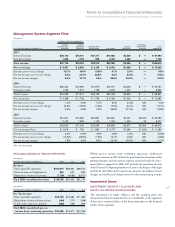

PLAN ASSETS

Defined Benefit Pension Plans

The company’s defined benefit pension plans’ asset allocations at

December 31, 2007 and 2006 and target allocation for 2008, by asset

category, are as follows:

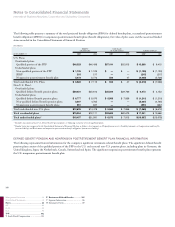

U.S. Plan (Actual Allocations)

PLAN ASSETS 2008

AT DECEMBER 31: TARGET

2007 2006 ALLOCATION

Asset Category:

Equity securities* 46.9% 63.9% 47%

Debt securities 44.6 31.2 43

Real Estate* 5.4 3.9 4

Other 3.1 1.0 6

Total 100.0% 100.0% 100%

* See the following discussion regarding certain private market assets, and future funding

commitments thereof, that are not as liquid as the publicly traded securities.

Material Non-U.S. Plans (Weighted-Average)

PLAN ASSETS 2008

AT DECEMBER 31: TARGET

2007 2006 ALLOCATION

Asset Category:

Equity securities 58.0% 62.7% 57%

Debt securities 37.8 34.8 39

Real estate 1.9 2.1 2

Other 2.3 0.4 2

Total 100.0% 100.0% 100%

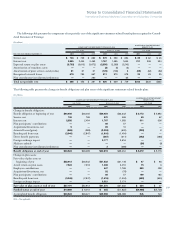

The investment objectives of the PPP portfolio are designed to gener-

ate returns that will enable the PPP to meet its future obligations. The

precise amount for which these obligations will be settled depends on

future events, including the retirement dates and life expectancy of the

plans’ participants. The obligations are estimated using actuarial

assumptions, based on the current economic environment. The PPP

portfolio’s investment strategy balances the requirement to generate

returns, using potentially higher yielding assets such as equity securi-

ties, with the need to control risk in the PPP portfolio with less volatile

assets, such as fixed-income securities. Risks include, among others,

inflation, volatility in equity values and changes in interest rates that

could cause the plans to become underfunded, thereby increasing

their dependence on contributions from the company. Within each

asset class, careful consideration is given to balancing the portfolio

among industry sectors, geographies, interest rate sensitivity, depen-

dence on economic growth, currency and other factors that affect

investment returns. During 2007, the company modified the asset

allocation of the PPP portfolio primarily by reducing public equity

securities, by increasing debt securities from 33 percent to 43 percent

of total plan assets, and by increasing the duration of debt securities

and increasing the use of derivatives, including interest rate swaps in

debt securities to further mitigate the effects of future interest rate

changes on the overfunded level of the PPP. These changes were

designed to reduce the potential negative impact that equity markets

or interest rates might have on the funded status of the PPP. These

changes did not impact the expected long-term return on plan assets

assumption, which remained at 8.00 percent for 2008. The effect on

expected long-term return on plan assets of increasing the duration

of debt securities substantially offset the effect of reducing public

equity securities. Derivatives are also used to hedge currency, adjust

portfolio duration and reduce specific market risks.

The assets are managed by professional investment firms, as well

as by investment professionals who are employees of the company.

They are bound by mandates and are measured against specific

benchmarks. Among these managers, consideration is given, but not

limited to, balancing security concentration, issuer concentration,

investment style and reliance on particular active and passive invest-

ment strategies. Market liquidity risks are tightly controlled, with

only a modest percentage of the PPP portfolio invested in private

market assets consisting of private equities and private real estate

investments, which are less liquid than publicly traded securities. The

PPP portfolio included private market assets comprising approxi-

mately 12.0 percent and 10.2 percent of total assets at December 31,

2007 and 2006, respectively. The target allocation for private market

assets in 2008 is 12.0 percent. As of December 31, 2007, the PPP

portfolio had $3,621 million in commitments for future private market

investments to be made over a number of years. These commitments

are expected to be funded from plan assets. Other assets in the PPP

portfolio include commodities and non-traditional investments

designed to further diversify the returns of the PPP portfolio.

Equity securities include IBM common stock of $111 million,

representing 0.2 percent of total PPP plan assets at December 31,

2007 and $159 million, representing 0.3 percent of total PPP plan

assets at December 31, 2006.