IBM 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ............................................................. 64

A. Significant Accounting Policies ..................64

B. Accounting Changes ...................................73

C. Acquisitions/Divestitures ...................... 76

D. Financial Instruments

(excluding derivatives).................................82

E. Inventories ...................................................83

F. Financing Receivables .................................83

G-M ..................................................................84

N-S ...................................................................94

T-W ................................................................102

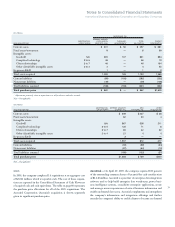

($ in millions)

ASCENTIAL

ORIGINAL AMOUNT

DISCLOSED

AMORTIZATION IN SECOND PURCHASE TOTAL OTHER

2005 ACQUISITIONS LIFE (IN YEARS) QTR. 2005 ADJUSTMENTS* ALLOCATION ACQUISITIONS

Current assets $ 526 $ (1) $ 525 $ 137

Fixed assets/noncurrent 20 — 20 28

Intangible assets:

Goodwill N/A 639 1 640 791

Completed technology 3 56 — 56 35

Client relationships 5 46 — 46 22

Other identifiable intangible assets 1– 5 — — — 5

In-process R&D — — — 1

Total assets acquired 1,287 — 1,287 1,019

Current liabilities (112) (4) (116) (89)

Noncurrent liabilities (35) 4 (31) (48)

Total liabilities assumed (147) — (147) (137)

Total purchase price $1,140 $ — $1,140 $ 882

* Adjustments primarily relate to acquisition costs, deferred taxes and other accruals.

N/A — Not applicable

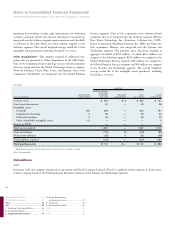

Divestitures

2007

In January 2007, the company announced an agreement with Ricoh Company Limited (“Ricoh”), a publicly traded company, to form a joint

venture company based on the Printing System Division (a division of the Systems and Technology segment).

businesses by providing a single, agile infrastructure for delivering

accurate, consistent, timely and coherent information. Ascential was

integrated into the Software segment upon acquisition and Goodwill,

as reflected in the table below, has been entirely assigned to the

Software segment. The overall weighted-average useful life of the

intangible assets purchased, excluding Goodwill, is 3.9 years.

Other Acquisitions — The company acquired 15 additional com-

panies that are presented as Other Acquisitions in the table below.

Four of the acquisitions were technology services-related companies

that were integrated into the Global Technology Services segment:

Network Solutions; Classic Blue; Corio; and Equitant. One of the

acquisitions, HealthLink, was integrated into the Global Business

Services segment. Nine of the acquisitions were software-related

companies that were integrated into the Software segment: iPhrase;

Data Power Technology, Inc.; Bowstreet; Collation Inc.; DWL;

Isogon Corporation; PureEdge Solutions, Inc.; SRD; and Gluecode.

One acquisition, Meiosys, was integrated into the Systems and

Technology segment. The purchase price allocations resulted in

aggregate Goodwill of $791 million, of which $456 million was

assigned to the Software segment; $239 million was assigned to the

Global Technology Services segment; $62 million was assigned to

the Global Business Services segment and $34 million was assigned

to the Systems and Technology segment. The overall weighted-

average useful life of the intangible assets purchased, excluding

Goodwill, is 3.1 years.