IBM 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ...................................................................64

G-M ............................................................ 84

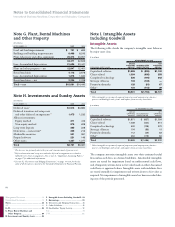

G. Plant, Rental Machines and

Other Property ...........................................84

H. Investments and Sundry Assets ..................84

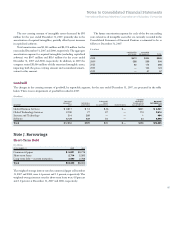

I. Intangible Assets Including Goodwill ........84

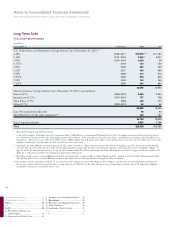

J. Borrowings ..................................................85

K. Derivatives and Hedging Transactions ........88

L. Other Liabilities .................................... 91

M. Stockholders’ Equity Activity ............... 92

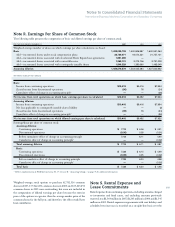

N-S ...................................................................94

T-W ................................................................102

The following table provides a roll forward of the current and noncurrent liabilities associated with these special actions. The current lia-

bilities presented in the table are included in Other accrued expenses and liabilities in the Consolidated Statement of Financial Position.

($ in millions)

LIABILITY LIABILITY

AS OF OTHER AS OF

DEC. 31, 2006 PAYMENTS ADJUSTMENTS* DEC. 31, 2007

Current:

Workforce $163 $(154) $121 $130

Space 88 (99) 41 30

Other 6 — 1 7

Total Current $257 $(253) $164 $167

Noncurrent:

Workforce $531 $ — $ 26 $557

Space 109 — (35) 74

Total Noncurrent $640 $ — $ (9) $631

* The Other adjustments column in the table above principally includes the reclassification of noncurrent to current and foreign currency translation adjustments. Also, in 2007, $81 million

was included in Other adjustments to record previously unrecognized actuarially calculated gains/losses related to long-term retirement benefits in Europe.

The workforce accruals primarily relate to the Global Services

business. The remaining liability relates to terminated employees

who are no longer working for the company who were granted

annual payments to supplement their incomes in certain countries.

Depending on the individual country’s legal requirements, these

required payments will continue until the former employee begins

receiving pension benefits or dies. Included in the December 31,

2007 workforce accruals above is $46 million associated with the

HDD divestiture discussed in note A, “Significant Accounting Policies,”

on page 64. The space accruals are for ongoing obligations to pay

rent for vacant space that could not be sublet or space that was sublet

at rates lower than the committed lease arrangement. The length of

these obligations varies by lease with the longest extending through

2020. Other accruals are primarily the remaining liabilities (other

than workforce or space) associated with the HDD divestiture.

The company employs extensive internal environmental protec-

tion programs that primarily are preventive in nature. The company

also participates in environmental assessments and cleanups at a

number of locations, including operating facilities, previously owned

facilities and Superfund sites. The company’s maximum exposure for

all environmental liabilities cannot be estimated and no amounts

have been recorded for non-ARO environmental liabilities that are

not probable or estimable. The total amounts accrued for non-ARO

environmental liabilities, including amounts classified as current in

the Consolidated Statement of Financial Position, that do not reflect

actual or anticipated insurance recoveries, were $261 million and

$252 million at December 31, 2007 and 2006, respectively. Estimated

environmental costs are not expected to materially affect the con-

solidated financial position or consolidated results of the company’s

operations in future periods. However, estimates of future costs are

subject to change due to protracted cleanup periods and changing

environmental remediation regulations.

Note M. Stockholders’ Equity Activity

The authorized capital stock of IBM consists of 4,687,500,000 shares

of common stock, $.20 par value, of which 1,385,234,138 shares were

outstanding at December 31, 2007 and 150,000,000 shares of pre-

ferred stock, $.01 par value, none of which were outstanding at

December 31, 2007.

Stock Repurchases

From time to time, the Board of Directors authorizes the company

to repurchase IBM common stock. The company repurchased

178,385,436 common shares at a cost of $18,783 million, 97,564,462

common shares at a cost of $8,022 million and 90,237,800 common

shares at a cost of $7,671 million in 2007, 2006 and 2005, respectively.

Included in the 2007 repurchases highlighted above, in May, IBM

International Group (IIG), a wholly owned foreign subsidiary of the

company repurchased 118.8 million shares of common stock for

$12.5 billion under accelerated share repurchase (ASR) agreements

with three banks.

Pursuant to the ASR agreements, executed on May 25, 2007, IIG

paid an initial purchase price of $105.18 per share for the repurchase.

The initial purchase price is subject to adjustment based on the vol-

ume weighted-average price of IBM common stock over a settlement

period of three months for each of the banks. The adjustment will also