IBM 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

Management Discussion ..................................14

Consolidated Statements ..................................58

Notes ........................................................... 64

A-F ............................................................. 64

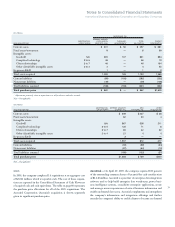

A. Significant Accounting Policies ..................64

B. Accounting Changes ...................................73

C. Acquisitions/Divestitures ...................... 76

D. Financial Instruments

(excluding derivatives) .......................... 82

E. Inventories ............................................. 83

F. Financing Receivables ........................... 83

G-M ..................................................................84

N-S ...................................................................94

T-W ................................................................102

was valued at $1,725 million, comprised of: $650 million in cash,

$542 million in Lenovo equity and $533 million in net liabilities

transferred. Transaction related expenses and provisions were $628

million, resulting in a net pre-tax gain of $1,097 million which was

recorded in Other (income) and expense in the Consolidated

Statement of Earnings in the second quarter of 2005. In addition, the

company paid Lenovo $138 million in cash primarily to assume addi-

tional liabilities outside the scope of the original agreement. This

transaction had no impact on Income from Continuing Operations.

Total net cash proceeds, less the deposit received at the end of 2004

for $25 million, related to these transactions were $487 million.

The equity received at the closing date represented 9.9 percent of

ordinary voting shares and 18.9 percent of total ownership in

Lenovo. Subsequent to the closing date, Lenovo’s capital structure

changed due to new third-party investments. As a result, the com-

pany’s equity at June 30, 2005 represented 9.9 percent of ordinary

voting shares and 17.05 percent of total ownership in Lenovo. The

equity securities have been accounted for under the cost method of

accounting. The equity is subject to specific lock-up provisions that

restrict the company from divesting the securities. These restrictions

apply to specific equity tranches and expire over a three-year period

from the closing date. The Lenovo equity was valued at $542 million

at the closing date and is recorded in Investments and sundry assets

in the Consolidated Statement of Financial Position. In addition, the

company recorded an equity deferral of $112 million to reflect the

value of the lock-up provisions. This deferral was recorded as a

contra-investment in Investments and sundry assets.

As part of the agreements with Lenovo, the company will provide

certain services. These services include marketing support, informa-

tion technology, human resources support and learning services. These

service arrangements are primarily for periods of three years or less

and can be terminated earlier by Lenovo. The company estimated the

fair value of these service arrangements, and, as a result, has deferred

$262 million of the transaction gain. This amount will be recorded

as revenue, primarily in the Global Services segments, as services are

provided to Lenovo. The deferred amount was recorded in Deferred

income in the Consolidated Statement of Financial Position.

The company also recorded direct and incremental expenses and

related provisions of $254 million associated with the divestiture,

consisting of $74 million for certain indemnities; $64 million for

employee-related charges; $40 million in real estate and information

technology costs; $20 million in transaction expenses; $22 million of

goodwill; and $34 million in other expenses. The company, as part of

the agreement, retained the right and will be given a preference to

provide maintenance, warranty and financing services to Lenovo.

The company retained the warranty liability for all Personal

Computing business products sold prior to the closing date. Lenovo

will have the right to use certain IBM Trademarks under a Trademark

License Agreement for a term of five years. In addition, the company

entered into an arm’s-length supply agreement with Lenovo for a

term of five years, designed to provide the company with computers

for its internal use.

In the third quarter of 2005, as a result of the third-party invest-

ments previously described, Lenovo was required to repurchase the

first equity tranche at a specified share price. The equity repurchase

resulted in the receipt of $152 million of cash and a pre-tax gain of

$17 million. As a result of this transaction, the company’s equity in

Lenovo at September 30, 2005 represented 9.9 percent of ordinary

voting shares and 14.88 percent of total ownership.

Also, in the second half of the year, the company received an

additional $23 million of cash from Lenovo related to working capi-

tal adjustments, net of expenses related to employee matters. These

transactions were consistent with the company’s previous estimates.

Overall, including the gain on the equity sale recorded in the third

quarter, the company recorded an additional net pre-tax gain of $11

million; the resulting net pre-tax gain for the year ending December

31, 2005 is $1,108 million.

In addition, at December 31, 2005, the deferred income bal-

ance related to the services arrangements previously discussed is

$169 million.

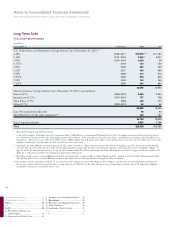

Note D. Financial Instruments

(excluding derivatives)

Fair Value of Financial Instruments

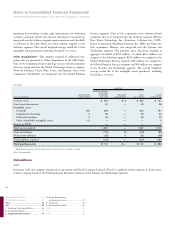

Cash and cash equivalents, marketable securities and derivative finan-

cial instruments are recognized and measured at fair value in the

company’s financial statements. Notes and other accounts receivable

and other investments are financial assets with carrying values

that approximate fair value. Accounts payable, other accrued expenses

and short-term debt are financial liabilities with carrying values

that approximate fair value. The carrying amount of long-term

debt is approximately $23.0 billion and $13.8 billion and the

estimated fair value is $26.5 billion and $16.2 billion at December 31,

2007 and 2006, respectively.

In the absence of quoted prices in active markets, considerable

judgment is required in developing estimates of fair value. Estimates

are not necessarily indicative of the amounts the company could real-

ize in a current market transaction. The following methods and

assumptions were used to estimate fair values: