IBM 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

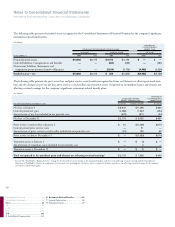

No significant amendments of the U.S. retirement-related benefit

plans or significant non-U.S. defined benefit pension plans occurred

during the years ended December 31, 2007, 2006 and 2005 that would

have a material effect on the Consolidated Statement of Earnings.

In 2006, the company redesigned certain non-U.S. defined ben-

efit pension plans that resulted in a reduction to the PBO of $688

million. The majority of the reduction was attributed to modified

plans in the United Kingdom, Switzerland and the Netherlands.

In December 2005, the company approved amendments to the PPP

and the SERP, which provided that participants would no longer accrue

benefits under these plans beginning January 1, 2008, resulting in a

curtailment charge of $267 million that was recorded in the Consolidated

Statement of Earnings for the year ended December 31, 2005.

ASSUMPTIONS USED TO DETERMINE PLAN

FINANCIAL INFORMATION

Underlying both the measurement of benefit obligations and net

periodic cost are actuarial valuations. These valuations use partici-

pant-specific information such as salary, age and years of service, as

well as certain assumptions, the most significant of which include

estimates of discount rates, expected return on plan assets, rate of

compensation increases, interest crediting rates and mortality rates.

The company evaluates these assumptions, at a minimum, annually,

and makes changes as necessary.

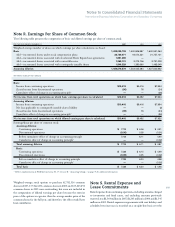

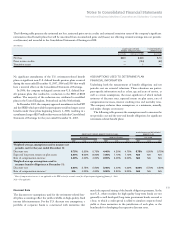

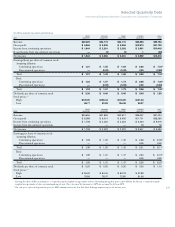

The following table presents the assumptions used to measure the

net periodic cost and the year-end benefit obligations for significant

retirement-related benefit plans:

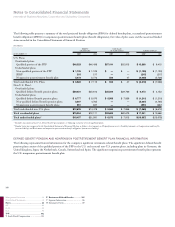

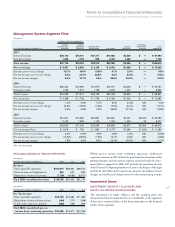

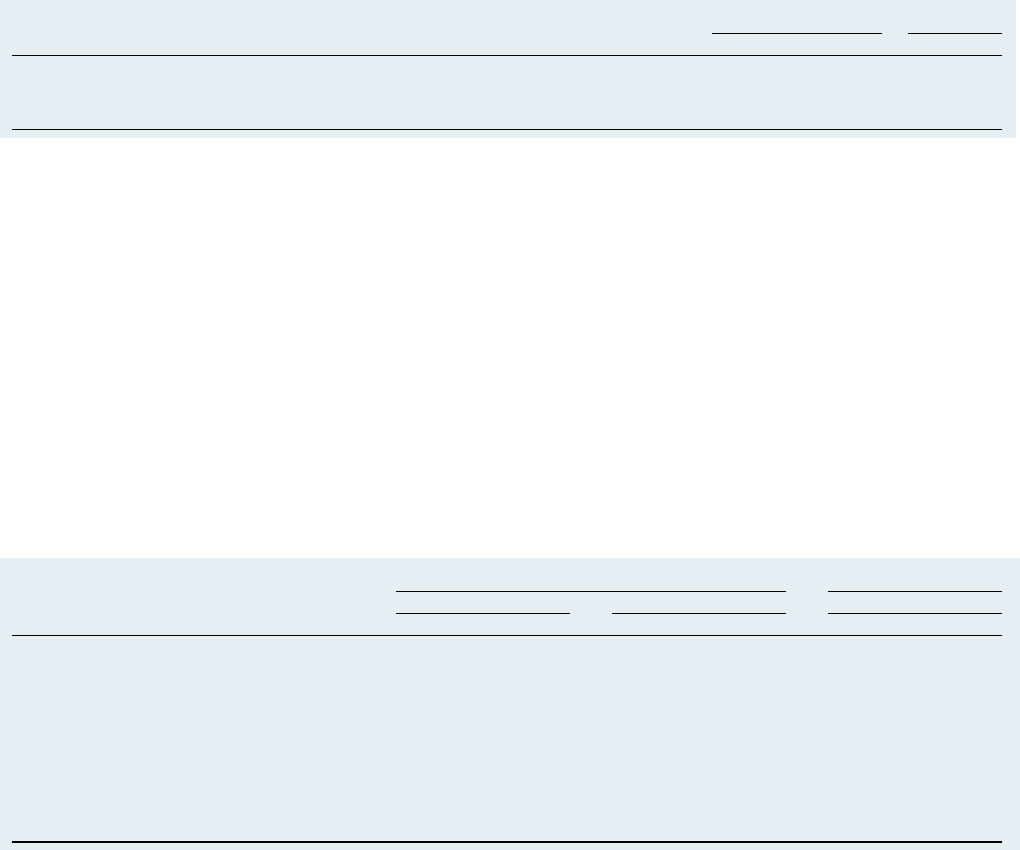

The following table presents the estimated net loss, estimated prior service credits and estimated transition assets of the company’s significant

retirement-related benefit plans that will be amortized from Accumulated gains and (losses) not affecting retained earnings into net periodic

cost/(income) and recorded in the Consolidated Statement of Earnings in 2008:

($ in millions)

SIGNIFICANT DEFINED POSTRETIREMENT

BENEFIT PENSION PLANS BENEFIT PLAN

U.S. PLAN NON-U.S. PLANS U.S. PLAN

Net loss $281 $ 600 $ 10

Prior service credits — (134) (62)

Transition assets — 1 —

NONPENSION POSTRETIREMENT

SIGNIFICANT DEFINED BENEFIT PENSION PLANS BENEFIT PLAN

U.S. PLAN NON-U.S. PLANS U.S. PLAN

2007 2006 2005 2007 2006 2005 2007 2006 2005

Weighted-average assumptions used to measure net

periodic cost for the year ended December 31:

Discount rate 5.75% 5.50% 5.75% 4.40% 4.20% 4.70% 5.75% 5.50% 5.75%

Expected long-term return on plan assets 8.00% 8.00% 8.00% 7.00% 7.10% 7.10% N/A N/A N/A

Rate of compensation increase 4.00% 4.00% 4.00% 2.90% 3.00% 3.00% N/A N/A N/A

Weighted-average assumptions used to

measure benefit obligations at December 31:

Discount rate 6.00% 5.75% 5.50% 5.40% 4.40% 4.20% 6.00% 5.75% 5.50%

Rate of compensation increase* N/A 4.00% 4.00% 3.00% 2.90% 3.00% N/A N/A N/A

* Rate of compensation increase is not applicable to the PPP as benefit accruals ceased for all participants beginning January 1, 2008.

N/A — Not applicable

Discount Rate

The discount rate assumptions used for the retirement-related ben-

efit plans accounting reflect the yields available on high-quality, fixed

income debt instruments. For the U.S. discount rate assumptions, a

portfolio of corporate bonds is constructed with maturities that

match the expected timing of the benefit obligation payments. In the

non-U.S., where markets for high-quality long-term bonds are not

generally as well developed, long-term government bonds are used as

a base, to which a credit spread is added to simulate corporate bond

yields at these maturities in the jurisdiction of each plan, as the

benchmark for developing the respective discount rates.