IBM 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 IBM annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

Notes to Consolidated Financial Statements

International Business Machines Corporation and Subsidiary Companies

reflect certain other amounts including the banks’ carrying costs,

compensation for ordinary dividends declared by the company dur-

ing the settlement period and interest benefits for receiving the $12.5

billion payment in advance of the anticipated purchases by each bank

of shares in the open market during the respective settlement periods.

The adjustment amount can be settled in cash, registered shares or

unregistered shares at IIG’s option. Under the ASR agreements, IIG

will have a separate settlement with each of the three banks. The first

settlement occurred on September 6, 2007, resulting in a settlement

payment to the bank of $151.8 million. The second settlement

occurred on December 5, 2007, resulting in a settlement payment to

the bank of $253.1 million. The amounts were paid in cash at the

election of IIG in accordance with the provisions of the ASR agree-

ments and were recorded as adjustments to Stockholders’ equity in the

Consolidated Statement of Financial Position on the settlement dates.

The remaining settlement is expected to occur in March 2008,

and any amounts to be paid or received by IIG under any of the set-

tlement alternatives in connection with the price adjustment will be

recorded as an adjustment to Stockholders’ equity in the Consolidated

Statement of Financial Position on the settlement date.

The estimated fair value of the cash settlement and share settle-

ment alternatives under the ASR agreements as of December 31,

2007 would result in the payment of approximately $33 million or

0.3 million registered shares or unregistered shares, by IIG. In

comparison, each $1 increase in the volume weighted-average share

price would increase these estimates by approximately $40 million or

approximately 0.3 million registered and unregistered shares under

the cash settlement and share settlement alternatives, respectively.

IIG cannot be required to deliver more than 119 million shares if it

elects the share settlement options for the remaining settlement,

regardless of the volume weighted-average share price.

On December 3, 2007, the company announced that it planned to

repurchase up to $1.0 billion of its outstanding common stock in open

market transactions by the end of February 2008. These repurchases,

originally planned for March and April of 2008, are in addition to the

$12.5 billion ASR discussed previously.

The company issued 9,282,055 treasury shares in 2007, 3,489,803

treasury shares in 2006 and 2,594,786 treasury shares in 2005, as a

result of exercises of stock options by employees of certain recently

acquired businesses and by non-U.S. employees. At December 31,

2007, $1,210 million of Board authorized repurchases was still avail-

able. The company plans to purchase shares on the open market

or in private transactions from time to time, depending on market

conditions. In connection with the issuance of stock as part of

the company’s stock-based compensation plans, 1,282,131 common

shares at a cost of $134 million, 633,769 common shares at a cost of

$52 million and 606,697 common shares at a cost of $52 million in

2007, 2006 and 2005, respectively, were remitted by employees to the

company in order to satisfy minimum statutory tax withholding

requirements. Such amounts are included in the Treasury stock bal-

ance in the Consolidated Statement of Financial Position and the

Consolidated Statement of Stockholders’ Equity.

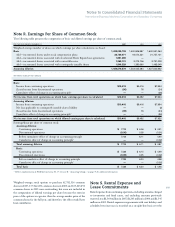

Accumulated Gains and (Losses) Not Affecting Retained Earnings (Net of Tax)

($ in millions)

RETIREMENT-RELATED BENEFIT PLANS

NET PRIOR SERVICE NET ACCUMULATED

UNREALIZED FOREIGN MINIMUM COSTS/(CREDITS), NET UNREALIZED GAINS/(LOSSES)

GAINS/(LOSSES) CURRENCY PENSION GAINS/(LOSSES) AND GAINS ON NOT AFFECTING

ON CASH FLOW TRANSLATION LIABILITY TRANSITION ASSETS, MARKETABLE RETAINED

HEDGE DERIVATIVES ADJUSTMENTS* ADJUSTMENTS NET OF AMORTIZATION SECURITIES EARNINGS

December 31, 2005 $ 238 $1,908 $(4,229) $ — $ 67 $(2,016)

Change for period (342) 1,020 1,881 — 53 2,613

Adoption of SFAS No. 158 — — 2,348 (11,846) — (9,498)

December 31, 2006 (104) 2,929 — (11,846) 119 (8,901)

Change for period (123) 726 — 4,678 206 5,487

December 31, 2007 $(227) $3,655 $ — $ (7,168) $325 $(3,414)

* Foreign currency translation adjustments are presented gross with associated hedges shown net of tax.

Net Change in Unrealized Gains on Marketable Securities (Net of Tax)

($ in millions)

FOR THE PERIOD ENDED DECEMBER 31: 2007 2006

Net unrealized gains arising during the period $246 $77

Less: Net gains included in net income for the period 40* 24*

Net change in unrealized gains on marketable securities $206 $53

* Includes writedowns of $6.4 million and $2.9 million in 2007 and 2006, respectively.