HP 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

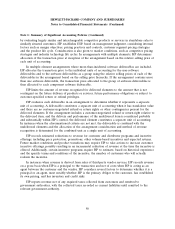

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

machinery and equipment. HP depreciates leasehold improvements over the life of the lease or the

asset, whichever is shorter. HP depreciates equipment held for lease over the initial term of the lease

to the equipment’s estimated residual value. The estimated useful lives of assets used solely to support

a customer services contract generally do not exceed the term of the customer contract. Upon

retirement or disposition, the asset cost and related accumulated depreciation are removed with any

gain or loss recognized in the Consolidated Statements of Earnings.

HP capitalizes certain internal and external costs incurred to acquire or create internal use

software, principally related to software coding, designing system interfaces and installation and testing

of the software. HP amortizes capitalized internal use software costs using the straight-line method over

the estimated useful lives of the software, generally from three to five years.

Business Combinations

HP includes the results of operations of the businesses that it has acquired in HP’s consolidated

results prospectively from the respective dates of acquisition. HP allocates the fair value of purchase

consideration to the assets acquired, liabilities assumed, and non-controlling interests in the acquired

entity generally based on their fair values at the acquisition date. The excess of the fair value of

purchase consideration over the fair value of these assets acquired, liabilities assumed and

non-controlling interests in the acquired entity is recorded as goodwill. The primary items that generate

goodwill include the value of the synergies between the acquired companies and HP and the acquired

assembled workforce, neither of which qualifies for recognition as an intangible asset. Acquisition-

related expenses and restructuring costs are recognized separately from the business combination and

are expensed as incurred.

Goodwill

HP reviews goodwill for impairment annually and whenever events or changes in circumstances

indicate the carrying amount of goodwill may not be recoverable. While HP is permitted to conduct a

qualitative assessment to determine whether it is necessary to perform a two-step quantitative goodwill

impairment test, for its annual goodwill impairment test in the fourth quarter of fiscal 2013, HP

performed a quantitative test for all of its reporting units.

Goodwill is tested for impairment at the reporting unit level. Except for the Enterprise Group

(‘‘EG’’) and Enterprise Services (‘‘ES’’), HP’s reporting units are consistent with the reportable

segments identified in Note 18. The Enterprise Group includes two reporting units, which are

Enterprise Servers, Storage and Networking (‘‘ESSN’’) and Technology Services (‘‘TS’’). ES also

consists of two reporting units, which are MphasiS Limited and the remainder of ES. In fiscal 2013, HP

made two changes to our reporting units. HP identified MphasiS Limited as a reporting unit apart from

the remainder of ES, and in connection with integration activities combined the Autonomy reporting

unit with the legacy HP software business reporting unit.

In the first step of the impairment test, HP compares the fair value of each reporting unit to its

carrying amount. HP estimates the fair value of its reporting units using a weighting of fair values

derived most significantly from the income approach and to a lesser extent the market approach. Under

the income approach, HP estimates the fair value of a reporting unit based on the present value of

estimated future cash flows. HP bases cash flow projections on management’s estimates of revenue

growth rates and operating margins, taking into consideration industry and market conditions. HP bases

91