HP 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

Operating Activities

Net cash provided by operating activities increased by $1.0 billion for fiscal 2013 as compared to

fiscal 2012. The increase was due primarily to the impact of improved payment terms from suppliers

and a reduction in payments associated with webOS contract cancellations, the impact of which was

partially offset due to higher cash utilization in inventory. Net cash provided by operating activities

decreased by $2.1 billion for fiscal 2012 as compared to fiscal 2011. The decrease was due primarily to

lower net earnings and higher utilization of cash resources for payment of accounts payable, the impact

of which was partially offset by lower investments in inventory and higher cash generated from

collections of accounts and financing receivables.

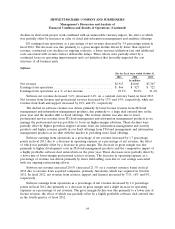

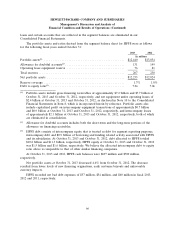

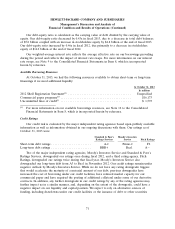

Our key working capital metrics are as follows:

October 31

2013 2012 2011

Days of sales outstanding in accounts receivable ........................... 49 49 51

Days of supply in inventory .......................................... 24 25 27

Days of purchases outstanding in accounts payable ......................... (56) (53) (52)

Cash conversion cycle .............................................. 17 21 26

Days of sales outstanding in accounts receivable (‘‘DSO’’) measures the average number of days

our receivables are outstanding. DSO is calculated by dividing ending accounts receivable, net of

allowance for doubtful accounts, by a 90-day average net revenue. Our accounts receivable balance was

$15.9 billion as of October 31, 2013.

Days of supply in inventory (‘‘DOS’’) measures the average number of days from procurement to

sale of our product. DOS is calculated by dividing ending inventory by a 90-day average cost of goods

sold. Our inventory balance was $6.0 billion as of October 31, 2013.

Days of purchases outstanding in accounts payable (‘‘DPO’’) measures the average number of days

our accounts payable balances are outstanding. DPO is calculated by dividing ending accounts payable

by a 90-day average cost of goods sold. Our accounts payable balance was $14.0 billion as of

October 31, 2013.

Our working capital requirements depend on effectively managing the cash conversion cycle, which

represents the number of days that elapse from the day we pay for the purchase of inventory to the

collection of cash from our customers. The cash conversion cycle is the sum of DSO and DOS less

DPO.

The cash conversion cycle for fiscal 2013 decreased by 4 days compared to fiscal 2012 and is below

what we expect to be a long-term sustainable rate. The DSO remained flat year over year. The

decrease in DOS was due to lower inventory balances, relative to the rate of decline in cost of goods

sold, in most segments as of October 31, 2013. The increase in DPO was primarily due to favorable

payment term changes partially offset by unfavorable purchasing linearity.

The cash conversion cycle for fiscal 2012 decreased by five days compared to fiscal 2011. The

decrease in DSO was due primarily to improved collections, an increase in cash discounts and a decline

in extended payment terms. Additionally, our DSO benefited from the current-period DSO calculation

containing a full quarter of revenue from our Autonomy acquisition versus the approximately one

month of revenue that was included in the prior-period DSO calculation. These favorable impacts to

69