HP 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

If the fair value of the reporting unit exceeds the carrying amount of the net assets assigned to

that reporting unit, goodwill is not impaired and no further testing is required. If the fair value of the

reporting unit is less than its carrying amount, then we must perform the second step of the

impairment test to measure the amount of impairment loss, if any. In the second step, the reporting

unit’s assets, including any unrecognized intangible assets, liabilities and non-controlling interests are

measured at fair value in a hypothetical analysis to calculate the implied fair value of goodwill for the

reporting unit in the same manner as if the reporting unit was being acquired in a business

combination. If the implied fair value of the reporting unit’s goodwill is less than its carrying amount,

the difference is recorded as an impairment loss.

Our annual goodwill impairment analysis, which we performed as of the first day of the fourth

quarter of fiscal 2013, did not result in any impairment charges. The excess of fair value over carrying

amount for each of our reporting units ranged from approximately 14% to approximately 1,200% of

carrying amounts. The Software and ESSN reporting units have the lowest excess of fair value over

carrying amount at 31% and 14%, respectively. In estimating the fair value of our reporting units, we

have taken into consideration the challenging industry and market trends that existed as of August 1,

2013, the date of the annual goodwill impairment test, for each respective reporting unit.

In order to evaluate the sensitivity of the estimated fair values of our reporting units in the

goodwill impairment test, we applied a hypothetical 10% decrease to the fair values of each reporting

unit. This hypothetical 10% decrease resulted in an excess of fair value over carrying amount ranging

from approximately 2% to approximately 1,000% of the carrying amounts. This hypothetical 10%

decrease resulted in the Software and ESSN reporting units having the lowest excess of fair value over

carrying amount of 18% and 2%, respectively. We will continue to monitor goodwill on an annual basis

as of the beginning of our fourth fiscal quarter and whenever events or changes in circumstances, such

as significant adverse changes in business climate or operating results, changes in management’s

business strategy or significant declines in our stock price, indicate that there may be potential indicator

of impairment.

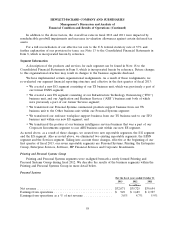

Intangible Assets

We review intangible assets with finite lives for impairment whenever events or changes in

circumstances indicate the carrying amount of an asset may not be recoverable. Recoverability of these

intangible assets is assessed based on the estimated undiscounted future cash flows expected to result

from the use of the asset. If the undiscounted future cash flows are less than the carrying amount, the

finite-lived intangible assets are considered to be impaired. The amount of the impairment loss, if any,

is measured as the difference between the carrying amount of the asset and its fair value. We estimate

the fair value of the finite-lived intangible assets by using an income approach or, when available and

appropriate, using a market approach.

Restructuring

We have engaged in restructuring actions, which require management to utilize significant

estimates related to the timing and amount of severance and other employee separation costs for

workforce reduction and enhanced early retirement programs, realizable values of assets made

redundant or obsolete, lease cancellation and other exit costs. We accrue for severance and other

employee separation costs under these actions when it is probable that benefits will be paid and the

amount is reasonably estimable. The rates used in determining severance accruals are based on existing

plans, historical experiences, and negotiated settlements. For a full description of our restructuring

48