HP 2013 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

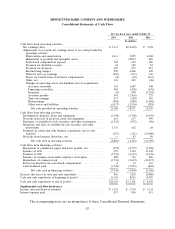

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Consolidated Statements of Cash Flows

For the fiscal years ended October 31

2013 2012 2011

In millions

Cash flows from operating activities:

Net earnings (loss) .................................. $5,113 $(12,650) $ 7,074

Adjustments to reconcile net earnings (loss) to net cash provided by

operating activities:

Depreciation and amortization ......................... 4,611 5,095 4,984

Impairment of goodwill and intangible assets ............... — 18,035 885

Stock-based compensation expense ...................... 500 635 685

Provision for doubtful accounts ........................ 61 142 81

Provision for inventory .............................. 275 277 217

Restructuring charges ............................... 990 2,266 645

Deferred taxes on earnings ........................... (410) (711) 166

Excess tax benefit from stock-based compensation ........... (2) (12) (163)

Other, net ....................................... 443 265 (46)

Changes in operating assets and liabilities (net of acquisitions):

Accounts receivable ............................... 530 1,687 448

Financing receivables .............................. 484 (418) (675)

Inventory ...................................... (4) 890 (1,252)

Accounts payable ................................ 541 (1,414) 275

Taxes on earnings ................................ 417 (320) 610

Restructuring ................................... (904) (840) (1,002)

Other assets and liabilities .......................... (1,037) (2,356) (293)

Net cash provided by operating activities ............... 11,608 10,571 12,639

Cash flows from investing activities:

Investment in property, plant and equipment ................. (3,199) (3,706) (4,539)

Proceeds from sale of property, plant and equipment ........... 653 617 999

Purchases of available-for-sale securities and other investments .... (1,243) (972) (96)

Maturities and sales of available-for-sale securities and other

investments ...................................... 1,153 662 68

Payments in connection with business acquisitions, net of cash

acquired ........................................ (167) (141) (10,480)

Proceeds from business divestiture, net ..................... — 87 89

Net cash used in investing activities .................. (2,803) (3,453) (13,959)

Cash flows from financing activities:

Repayment of commercial paper and notes payable, net ......... (154) (2,775) (1,270)

Issuance of debt .................................... 279 5,154 11,942

Payment of debt .................................... (5,721) (4,333) (2,336)

Issuance of common stock under employee stock plans .......... 288 716 896

Repurchase of common stock ........................... (1,532) (1,619) (10,117)

Excess tax benefit from stock-based compensation ............. 2 12 163

Cash dividends paid .................................. (1,105) (1,015) (844)

Net cash used in financing activities .................. (7,943) (3,860) (1,566)

Increase (decrease) in cash and cash equivalents ................ 862 3,258 (2,886)

Cash and cash equivalents at beginning of period ............... 11,301 8,043 10,929

Cash and cash equivalents at end of period ................... $12,163 $ 11,301 $ 8,043

Supplemental cash flow disclosures:

Income taxes paid (net of refunds) ......................... $ 1,391 $ 1,750 $ 1,134

Interest expense paid .................................. 837 856 451

The accompanying notes are an integral part of these Consolidated Financial Statements.

83