HP 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

under our existing shelf registration statement, if necessary to offset reductions in the market capacity

for our commercial paper.

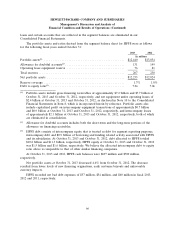

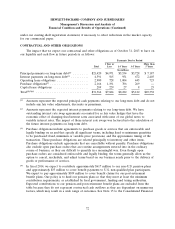

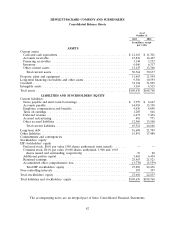

CONTRACTUAL AND OTHER OBLIGATIONS

The impact that we expect our contractual and other obligations as of October 31, 2013 to have on

our liquidity and cash flow in future periods is as follows:

Payments Due by Period

1 Year or More than

Total Less 1-3 Years 3-5 Years 5 Years

In millions

Principal payments on long-term debt(1) ......... $21,420 $4,971 $5,534 $3,728 $ 7,187

Interest payments on long-term debt(2) .......... 4,591 565 951 672 2,403

Operating lease obligations .................. 2,900 728 1,004 445 723

Purchase obligations(3) ...................... 2,166 1,191 706 269 —

Capital lease obligations .................... 289 229 27 8 25

Total(4)(5)(6) .............................. $31,366 $7,684 $8,222 $5,122 $10,338

(1) Amounts represent the expected principal cash payments relating to our long-term debt and do not

include any fair value adjustments, discounts or premiums.

(2) Amounts represent the expected interest payments relating to our long-term debt. We have

outstanding interest rate swap agreements accounted for as fair value hedges that have the

economic effect of changing fixed interest rates associated with some of our global notes to

variable interest rates. The impact of these interest rate swaps was factored into the calculation of

the future interest payments on long-term debt.

(3) Purchase obligations include agreements to purchase goods or services that are enforceable and

legally binding on us and that specify all significant terms, including fixed or minimum quantities

to be purchased; fixed, minimum or variable price provisions; and the approximate timing of the

transaction. These purchase obligations are related principally to inventory and other items.

Purchase obligations exclude agreements that are cancellable without penalty. Purchase obligations

also exclude open purchase orders that are routine arrangements entered into in the ordinary

course of business, as they are difficult to quantify in a meaningful way. Even though open

purchase orders are considered enforceable and legally binding, the terms generally allow us the

option to cancel, reschedule, and adjust terms based on our business needs prior to the delivery of

goods or performance of services.

(4) In fiscal 2014, we expect to contribute approximately $617 million to our non-U.S. pension plans

and approximately $33 million to cover benefit payments to U.S. non-qualified plan participants.

We expect to pay approximately $109 million to cover benefit claims for our post-retirement

benefit plans. Our policy is to fund our pension plans so that they meet at least the minimum

contribution requirements, as established by local government, funding and taxing authorities.

Expected contributions to our pension and post-retirement benefit plans are excluded from the

table because they do not represent contractual cash outflows as they are dependent on numerous

factors, which may result in a wide range of outcomes. See Note 15 to the Consolidated Financial

72