HP 2013 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

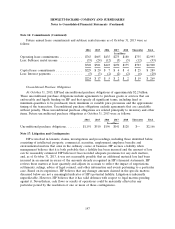

Note 16: Commitments (Continued)

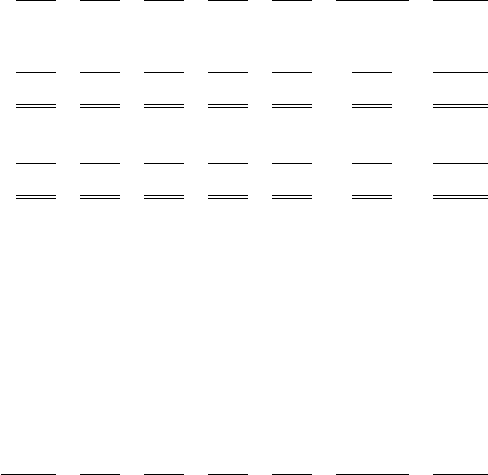

Future annual lease commitments and sublease rental income as of October 31, 2013 were as

follows:

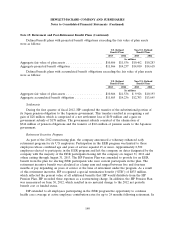

2014 2015 2016 2017 2018 Thereafter Total

In millions

Operating lease commitments ............. $763 $605 $435 $275 $180 $735 $2,993

Less: Sublease rental income ............. (35) (24) (12) (5) (5) (12) (93)

$728 $581 $423 $270 $175 $723 $2,900

Capital lease commitments ............... $229 $ 20 $ 7 $ 4 $ 4 $ 25 $ 289

Less: Interest payments ................. (5) (3) (2) (2) (2) (6) (20)

$224 $ 17 $ 5 $ 2 $ 2 $ 19 $ 269

Unconditional Purchase Obligations

At October 31, 2013, HP had unconditional purchase obligations of approximately $2.2 billion.

These unconditional purchase obligations include agreements to purchase goods or services that are

enforceable and legally binding on HP and that specify all significant terms, including fixed or

minimum quantities to be purchased, fixed, minimum or variable price provisions and the approximate

timing of the transaction. Unconditional purchase obligations exclude agreements that are cancelable

without penalty. These unconditional purchase obligations are related principally to inventory and other

items. Future unconditional purchase obligations at October 31, 2013 were as follows:

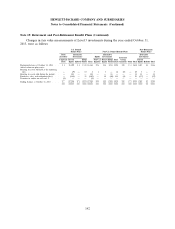

2014 2015 2016 2017 2018 Thereafter Total

In millions

Unconditional purchase obligations ........ $1,191 $510 $196 $141 $128 $— $2,166

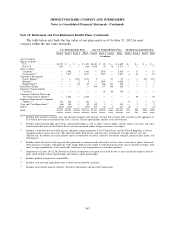

Note 17: Litigation and Contingencies

HP is involved in lawsuits, claims, investigations and proceedings, including those identified below,

consisting of intellectual property, commercial, securities, employment, employee benefits and

environmental matters that arise in the ordinary course of business. HP accrues a liability when

management believes that it is both probable that a liability has been incurred and the amount of loss

can be reasonably estimated. HP believes it has recorded adequate provisions for any such matters,

and, as of October 31, 2013, it was not reasonably possible that an additional material loss had been

incurred in an amount in excess of the amounts already recognized in HP’s financial statements. HP

reviews these matters at least quarterly and adjusts its accruals to reflect the impact of negotiations,

settlements, rulings, advice of legal counsel, and other information and events pertaining to a particular

case. Based on its experience, HP believes that any damage amounts claimed in the specific matters

discussed below are not a meaningful indicator of HP’s potential liability. Litigation is inherently

unpredictable. However, HP believes that it has valid defenses with respect to legal matters pending

against it. Nevertheless, cash flows or results of operations could be materially affected in any

particular period by the resolution of one or more of these contingencies.

147