HP 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

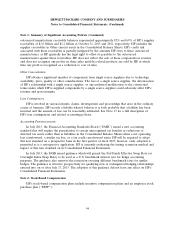

Note 2: Stock-Based Compensation (Continued)

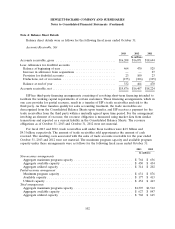

average assumptions, in addition to projections of market conditions, used to measure the weighted-

average fair values were as follows for fiscal years ended October 31:

2013 2012 2011

Weighted-average fair value of grants per unit ...................... $0.00(1) $3.35(2) $27.59(3)

Expected volatility(4) ......................................... 33% 41% 30%

Risk-free interest rate ........................................ 0.18% 0.14% 0.38%

Expected dividend yield ...................................... 3.94% 1.78% 0.75%

Expected term in months ..................................... 12 15 19

(1) Reflects the weighted-average fair value for the third year of the three-year performance period

applicable to PRUs granted in fiscal 2011. The weighted-average fair value per unit is zero based

on the result of the Monte-Carlo simulation model using the weighted-average assumptions on the

measurement date.

(2) Reflects the weighted-average fair value for the third year of the three-year performance period

applicable to PRUs granted in fiscal 2010 and for the second year of the three-year performance

period applicable to PRUs granted in fiscal 2011.

(3) Reflects the weighted-average fair value for the third year of the three-year performance period

applicable to PRUs granted in fiscal 2009, for the second year of the three-year performance

period applicable to PRUs granted in fiscal 2010 and for the first year of the three-year

performance period applicable to PRUs granted in fiscal 2011.

(4) HP uses historic volatility for PRU awards when simulating multivariate prices for companies in

the S&P 500.

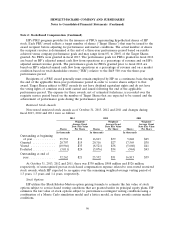

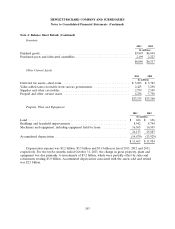

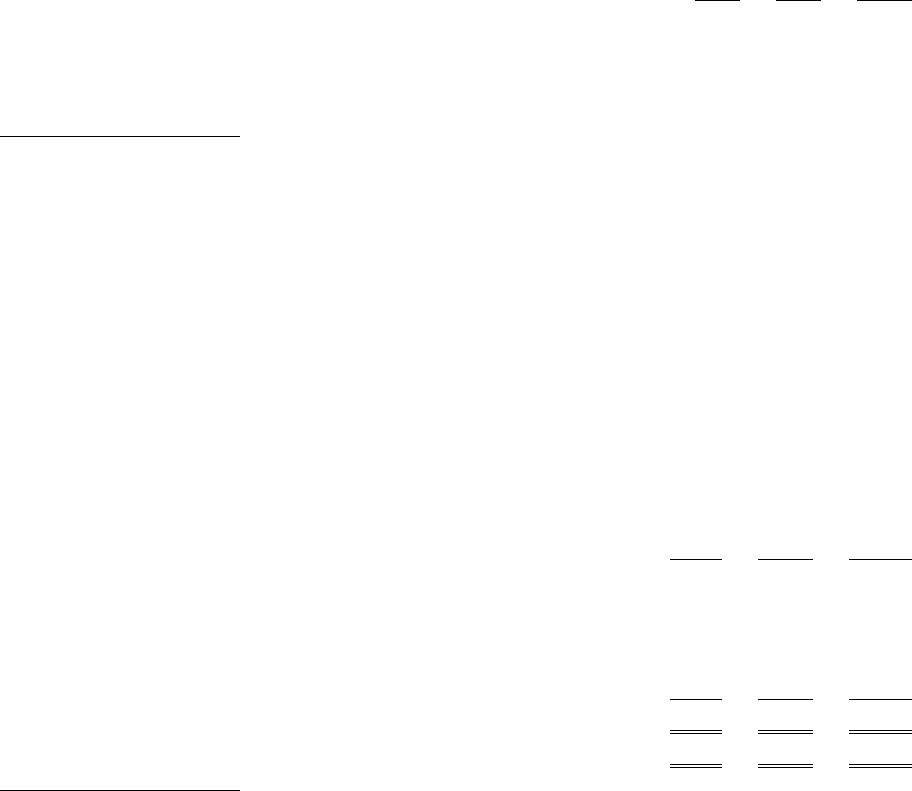

Non-vested PRUs as of October 31, 2013, 2012 and 2011 and changes during fiscal 2013, 2012 and

2011 were as follows:

2013 2012 2011

Shares in thousands

Outstanding Target Shares at beginning of year ................... 5,688 11,382 18,508

Granted ................................................ — 1,251 5,950

Change in units due to performance and market conditions achievement

for PRUs vested in the year(1) .............................. (4,307) (5,617) (10,862)

Forfeited ............................................... (356) (1,328) (2,214)

Outstanding Target Shares at end of year ........................ 1,025 5,688 11,382

Outstanding Target Shares of PRUs assigned a fair value at end of year . 690(2) 3,492(3) 5,867(4)

(1) The minimum level of TSR was not met for PRUs granted in fiscal 2011, 2010 and 2009, which

resulted in the cancellation of Target Shares.

(2) Excludes Target Shares for the third year for PRUs granted in fiscal 2012 as the measurement date

had not yet been established. The measurement date and related fair value for the excluded PRUs

will be established when the annual performance goals are approved.

(3) Excludes Target Shares for the third year for PRUs granted in fiscal 2011 and for the second and

third years for PRUs granted in fiscal 2012 as the measurement dates had not yet been

established.

99