HP 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Management’s Discussion and Analysis of

Financial Condition and Results of Operations (Continued)

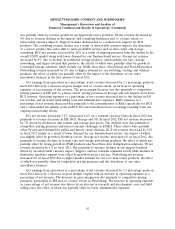

In addition to the above factors, the overall tax rates in fiscal 2012 and 2011 were impacted by

nondeductible goodwill impairments and increases in valuation allowances against certain deferred tax

assets.

For a full reconciliation of our effective tax rate to the U.S. federal statutory rate of 35% and

further explanation of our provision for taxes, see Note 13 to the Consolidated Financial Statements in

Item 8, which is incorporated herein by reference.

Segment Information

A description of the products and services for each segment can be found in Note 18 to the

Consolidated Financial Statements in Item 8, which is incorporated herein by reference. Future changes

to this organizational structure may result in changes to the business segments disclosed.

We have implemented certain organizational realignments. As a result of these realignments, we

re-evaluated our segment financial reporting structure and, effective in the first quarter of fiscal 2013:

• We created a new EG segment consisting of our TS business unit, which was previously a part of

our former ESSN segment;

• We created a new ES segment consisting of our Infrastructure Technology Outsourcing (‘‘ITO’’)

business unit, and our Application and Business Services (‘‘ABS’’) business unit both of which

were previously a part of our former Services segment;

• We transferred our Personal Systems commercial products support business from our TS

business unit to the Other business unit within our Personal Systems segment;

• We transferred our end-user workplace support business from our TS business unit to our ITO

business unit within our new ES segment; and

• We transferred the portion of our business intelligence services business that was a part of our

Corporate Investments segment to our ABS business unit within our new ES segment.

As noted above, as a result of these changes, we created two new reportable segments, the EG segment

and the ES segment. Also as noted above, we eliminated two existing reportable segments, the ESSN

segment and the Services segment. Taking into account these changes, effective at the beginning of our

first quarter of fiscal 2013, our seven reportable segments are Personal Systems, Printing, the Enterprise

Group, Enterprise Services, Software, HP Financial Services and Corporate Investments.

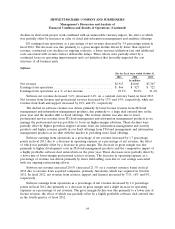

Printing and Personal Systems Group

Printing and Personal Systems segments were realigned beneath a newly formed Printing and

Personal Systems Group during fiscal 2012. We describe the results of the business segments within the

Printing and Personal Systems Group in more detail below.

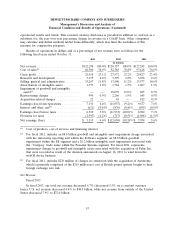

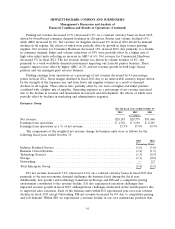

Personal Systems

For the fiscal years ended October 31

2013 2012 2011

In millions

Net revenue ........................................... $32,071 $35,725 $39,654

Earnings from operations ................................. $ 949 $ 1,689 $ 2,327

Earnings from operations as a % of net revenue ................ 3.0% 4.7% 5.9%

58