HP 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

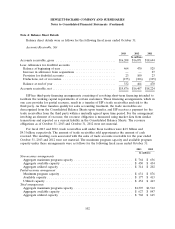

outsourced manufacturer receivable balances represented approximately 82% and 69% of HP’s supplier

receivables of $1.0 billion and $1.2 billion at October 31, 2013 and 2012, respectively. HP includes the

supplier receivables in Other current assets in the Consolidated Balance Sheets. HP’s credit risk

associated with these receivables is partially mitigated by the amounts HP owes to these outsourced

manufacturers, as HP generally has the legal right to offset its payables to the outsourced

manufacturers against these receivables. HP does not reflect the sale of these components in revenue

and does not recognize any profits on these sales until the related products are sold by HP, at which

time any profit is recognized as a reduction to cost of sales.

Other Concentration

HP obtains a significant number of components from single source suppliers due to technology,

availability, price, quality or other considerations. The loss of a single source supplier, the deterioration

of HP’s relationship with a single source supplier, or any unilateral modification to the contractual

terms under which HP is supplied components by a single source supplier could adversely affect HP’s

revenue and gross margins.

Loss Contingencies

HP is involved in various lawsuits, claims, investigations and proceedings that arise in the ordinary

course of business. HP records a liability when it believes it is both probable that a liability has been

incurred and the amount of loss can be reasonably estimated. See Note 17 for a full description of

HP’s loss contingencies and related accounting policies.

Accounting Pronouncements

In July 2013, the Financial Accounting Standards Board (‘‘FASB’’) issued a new accounting

standard that will require the presentation of certain unrecognized tax benefits as reductions to

deferred tax assets rather than as liabilities in the Consolidated Balance Sheets when a net operating

loss carryforward, a similar tax loss, or a tax credit carryforward exists. HP will be required to adopt

this new standard on a prospective basis in the first quarter of fiscal 2015; however, early adoption is

permitted as is a retrospective application. HP is currently evaluating the timing, transition method and

impact of this new standard on its Consolidated Financial Statements.

In July 2013, the FASB issued guidance which will permit the Fed Funds Effective Swap Rate (or

Overnight Index Swap Rate) to be used as a U.S. benchmark interest rate for hedge accounting

purposes. The guidance also removes the restriction on using different benchmark rates for similar

hedges. The guidance is effective prospectively for qualifying new or redesignated hedging relationships

entered into on or after July 17, 2013. The adoption of this guidance did not have any effect on HP’s

Consolidated Financial Statements.

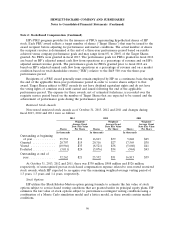

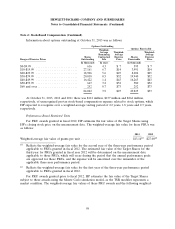

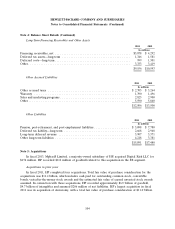

Note 2: Stock-Based Compensation

HP’s stock-based compensation plans include incentive compensation plans and an employee stock

purchase plan (‘‘ESPP’’).

94