HP 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements (Continued)

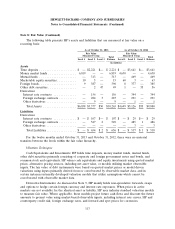

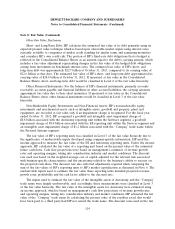

Note 9: Financial Instruments (Continued)

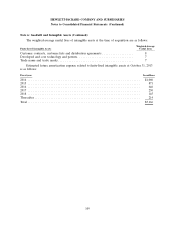

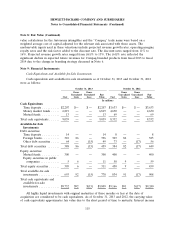

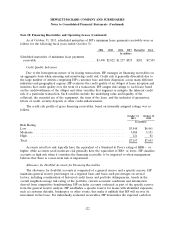

Fair Value of Derivative Instruments in the Consolidated Balance Sheets

As discussed in Note 8, HP estimates the fair values of derivatives primarily based on pricing

models using current market rates and records all derivatives on the balance sheet at fair value. The

gross notional and fair value of derivative financial instruments in the Consolidated Balance Sheets

were as follows:

As of October 31, 2013 As of October 31, 2012

Long-Term Long-Term

Financing Financing

Other Receivables Other Long-Term Other Receivables Other Long-Term

Gross Current and Other Accrued Other Gross Current and Other Accrued Other

Notional(1) Assets Assets Liabilities Liabilities Notional(1) Assets Assets Liabilities Liabilities

In millions

Derivatives designated as

hedging instruments

Fair value hedges:

Interest rate contracts .... $11,100 $ 31 $125 $ — $107 $ 7,900 $ 43 $276 $ — $ —

Cash flow hedges:

Foreign exchange contracts . 22,463 79 40 341 80 19,409 160 24 277 79

Net investment hedges:

Foreign exchange contracts . 1,920 30 40 20 12 1,683 14 15 36 24

Total derivatives designated as

hedging instruments ..... 35,483 140 205 361 199 28,992 217 315 313 103

Derivatives not designated as

hedging instruments

Foreign exchange contracts . . 16,048 72 26 76 20 18,687 61 17 51 19

Interest rate contracts(2) .... — — — — — 2,200 25 — 29 —

Other derivatives ........ 344 8 1 — — 383 1 — 3 —

Total derivatives not designated

as hedging instruments .... 16,392 80 27 76 20 21,270 87 17 83 19

Total derivatives ......... $51,875 $220 $232 $437 $219 $50,262 $304 $332 $396 $122

(1) Represents the face amounts of contracts that were outstanding as of October 31, 2013 and October 31, 2012, respectively.

(2) Represents offsetting swaps acquired through previous business combinations that were not designated as hedging instruments.

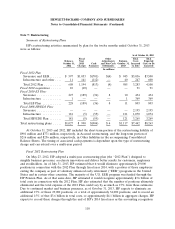

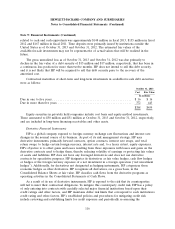

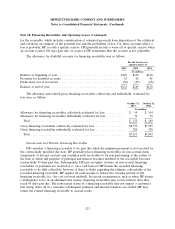

Effect of Derivative Instruments on the Consolidated Statements of Earnings

The pre-tax effect of derivative instruments and related hedged items in a fair value hedging

relationship for fiscal years ended October 31, 2013 and October 31, 2012 were as follows:

(Loss) Gain Recognized in Income on Derivative and Related Hedged Item

Derivative Instrument Location 2013 Hedged Item Location 2013

In millions In millions

Interest rate contracts ..... Interest and other, net $(270) Fixed-rate debt Interest and other, net $270

(Loss) Gain Recognized in Income on Derivative and Related Hedged Item

Derivative Instrument Location 2012 Hedged Item Location 2012

In millions In millions

Interest rate contracts ..... Interest and other, net $(130) Fixed-rate debt Interest and other, net $134

119