HP 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 HP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.HEWLETT-PACKARD COMPANY AND SUBSIDIARIES

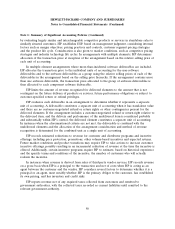

Notes to Consolidated Financial Statements (Continued)

Note 1: Summary of Significant Accounting Policies (Continued)

Debt and Marketable Equity Securities

Debt and marketable equity securities are generally considered available-for-sale and are reported

at fair value with unrealized gains and losses, net of applicable taxes, recorded in Accumulated other

comprehensive loss in the Consolidated Balance Sheets. Realized gains and losses for available-for-sale

securities are calculated based on the specific identification method and included in Interest and other,

net in the Consolidated Statement of Earnings. HP monitors its investment portfolio for impairment on

a quarterly basis. When the carrying value of an investment in debt securities exceeds its fair value and

the decline in value is determined to be an other-than-temporary decline (i.e., when HP does not

intend to sell the debt securities and it is not more likely than not that HP will be required to sell the

debt securities prior to anticipated recovery of its amortized cost basis), HP records an impairment

charge to Interest and other, net in the amount of the credit loss and the balance, if any, to

Accumulated other comprehensive loss in the Consolidated Balance Sheets.

Allowance for Doubtful Accounts for Accounts Receivable

HP establishes an allowance for doubtful accounts for account receivables. HP records a specific

reserve for individual accounts when HP becomes aware of specific customer circumstances, such as in

the case of bankruptcy filings or a deterioration in the customer’s operating results or financial

position. If there are additional changes in circumstances related to the specific customer, HP further

adjusts estimates of the recoverability of receivables. HP maintains bad debt reserves for all other

customers based on a variety of factors, including the use of third-party credit risk models that generate

quantitative measures of default probabilities based on market factors, the financial condition of

customers, the length of time receivables are past due, trends in the weighted-average risk rating for

the portfolio, macroeconomic conditions, information derived from competitive benchmarking,

significant one-time events and historical experience. The past due or delinquency status of a receivable

is based on the contractual payment terms of the receivable.

Inventory

HP values inventory at the lower of cost or market. Cost is computed using standard cost which

approximates actual cost on a first-in, first-out basis. Adjustments to reduce the cost of inventory to its

net realizable value are made, if required, for estimated excess, obsolete or impaired balances.

Derivatives

HP uses derivative financial instruments, primarily non-speculative forwards, swaps, and options, to

hedge certain foreign currency and interest rate exposures. HP also may use other derivative

instruments not designated as hedges, such as forwards used to hedge foreign currency balance sheet

exposures. HP does not use derivative financial instruments for speculative purposes. See Note 9 for a

full description of HP’s derivative financial instrument activities and related accounting policies.

Property, Plant and Equipment

HP states property, plant and equipment at cost less accumulated depreciation. HP capitalizes

additions and improvements and expenses maintenance and repairs as incurred. Depreciation is

computed using straight-line or accelerated methods over the estimated useful lives of the assets.

Estimated useful lives are five to 40 years for buildings and improvements and three to 15 years for

90